Table of Contents

Introduction: Fair Work for Casuals — Superannuation, Loadings & Workers’ Compensation

Casual employment powers a huge slice of Australia’s workforce across hospitality, retail, construction, healthcare and community services. But paying casuals correctly, staying compliant with awards, and keeping superannuation and insurance obligations straight can be complicated—especially when legislation and pay guides change.

This guide merges and updates three RosterElf articles—casual rights and superannuation, BACA casual loadings and overtime, and workers’ compensation for casuals—into one practical reference. It’s written for owners and managers who need clear, plain-English guidance and a repeatable process that reduces admin and risk.

Heads-up: This is general information only—it isn’t legal or financial advice. Always confirm details with the Fair Work Ombudsman, the ATO, and your state/territory workers’ compensation regulator before you make decisions for your business.

If you’d like to cut errors and paperwork, start with an integrated toolkit for rosters, live attendance, award interpretation and payroll export: Employee Rostering, Time & Attendance, Award Interpretation and Payroll Integration.

What Casual Employment Means Under Fair Work (2025)

Under Fair Work, a casual employee has no firm advance commitment to continuing and indefinite work. In practice, that means hours can vary from week to week and there isn’t a guaranteed pattern of shifts. Casuals typically receive a casual loading on ordinary hours to compensate for certain entitlements they don’t receive (for example, paid annual leave).

Key rights and documents for casual employees

- Casual Employment Information Statement (CEIS): employers must give casuals the CEIS at commencement and at other specified points. See the CEIS page.

- Access to conversion pathways: recent reforms provide an employee-choice pathway to move from casual to permanent in certain circumstances, subject to eligibility and timing rules. Review the FWO’s guidance on casual employees.

- National Employment Standards (NES): unpaid carer’s leave, compassionate leave, unpaid community service leave and paid family and domestic violence leave apply subject to criteria. Check the NES.

Why patterns of work matter

If a casual’s roster becomes regular and predictable over time, this may signal a change in the real nature of the relationship. Keep accurate records of shifts, breaks and offers of ongoing work to support decisions. RosterElf’s Rostering, Availability and Time & Attendance provide the audit trail you’ll rely on if questions arise.

Casual Superannuation: SG, OTE & Stapled Funds

Casuals are generally entitled to the Superannuation Guarantee (SG) on their ordinary time earnings (OTE). OTE usually includes base pay for ordinary hours and shift/casual loadings, but excludes overtime payments worked outside ordinary hours. Always confirm the current SG rate and OTE rules with the ATO: Super for employers.

Eligibility rules (including under-18s)

- Most casuals are eligible for SG. The previous $450-per-month threshold no longer applies.

- Under-18s generally need to work more than 30 hours in a week to qualify for SG for that week—confirm details with the ATO.

Stapled super funds

If a new casual doesn’t choose a fund, you must request the employee’s stapled super fund from the ATO and pay SG into that fund. Read more at Stapled super funds.

Quarterly due dates & late payments

SG must be received by the super fund at least quarterly (due 28 October, 28 January, 28 April and 28 July). Missed or late payments can trigger the Superannuation Guarantee Charge (SGC), which is not tax-deductible and may include interest and administration fees. See the ATO’s guidance on paying super contributions and the SGC.

OTE basics: what to include, what to exclude

- Include: base pay for ordinary hours, most allowances and casual loadings on ordinary hours.

- Exclude: overtime payments for hours worked outside ordinary hours.

Worked example (illustrative only)

A casual is paid $28.00/hour base for 38 ordinary hours in a week. The casual loading (25%) is $7.00/hour. Ordinary hours earnings are $1,064.00; casual loading totals $266.00. OTE for that week is $1,330.00. Apply the current SG rate to the OTE figure. Overtime worked beyond ordinary hours is not OTE.

To reduce errors, configure OTE rules once and let software do the maths. RosterElf’s Award Interpretation separates ordinary hours from overtime and exports clean earnings lines via Payroll Integration.

Casual Loadings, Penalties & Overtime Under BACA (MA000020)

Many construction roles are covered by the Building and Construction General On-site Award (BACA). Under BACA, casual employees receive a 25% casual loading on ordinary hours. When overtime or penalty conditions apply, casual rates are uplifted to incorporate the loading, not simply “base + 25%”. Always check current pay guides for the exact figures for your classification.

How overtime and penalties interact with casual loading (plain English)

- Where the award penalty is 150%, a casual typically receives 175% of the ordinary hourly rate.

- Where the penalty is 200%, a casual typically receives 225% of the ordinary hourly rate.

- On public holidays, a casual may be entitled to around 275% of the ordinary hourly rate.

These figures are a guide only—confirm the current clauses and rates in the official pay guides: Fair Work pay guides, and reference BACA (MA000020).

BACA example (illustrative only)

Base classification rate: $30.00/hour.

- Ordinary hours (casual): $30.00 + 25% = $37.50/hour (OTE for super).

- Weekday overtime (first 2 hours): 175% × $30.00 = $52.50/hour.

- Further weekday overtime / Sundays: 225% × $30.00 = $67.50/hour.

- Public holiday: 275% × $30.00 = $82.50/hour.

Myth-buster: casual loading does not replace overtime. If a casual works outside ordinary hours, overtime or penalty rates still apply under the award.

RosterElf’s Award Interpretation and Time & Attendance handle overtime triggers, weekend/public holiday penalties and allowances prior to export to Xero/MYOB via Payroll Integration.

Workers’ Compensation for Casual Employees

Casuals are typically covered under state and territory workers’ compensation schemes if they suffer a work-related injury or illness. Coverage, weekly payment calculations and medical/recovery benefits vary by jurisdiction, but the duty to hold insurance (where required) and to manage claims applies to employers regardless of whether staff are full-time, part-time or casual.

Where to start (regulator links)

- NSW: icare — Workers compensation insurance

- VIC: WorkSafe Victoria — WorkCover insurance

- QLD, SA, WA, TAS, NT, ACT: check your regulator’s site for policy requirements, claims process and employer obligations.

How a casual makes a claim (typical steps)

- Report the incident to the employer as soon as practicable (keep a written log).

- Visit a GP and obtain a certificate of capacity or equivalent.

- Lodge the claim through the insurer (or regulator) using the correct form.

- Participate in return-to-work planning with graduated duties where medically appropriate.

Clean attendance and timesheet records help resolve claims quickly. Use RosterElf’s Time Clock app (GPS + optional photo proof) with Time & Attendance to capture who worked, when and where.

Payroll & Record-Keeping Essentials for Casuals

Five foundations to get right

- Contracts & onboarding: use clear casual employment contracts and provide the CEIS. Digitise new starter forms with RosterElf Onboarding.

- Rosters & time capture: publish rosters and capture clock-ins/outs and breaks with Rostering and Time & Attendance.

- Award classification & rates: apply the correct award, classification and allowances. Let Award Interpretation calculate loadings, penalties and overtime.

- Payroll export: approve timesheets and export to payroll (e.g., Xero, MYOB) via Payroll Integration.

- Superannuation: confirm the fund (or request a stapled fund) and pay SG on time. Keep evidence of contributions and employee choices.

Record-keeping under Fair Work

Employers must keep accurate time and wages records and provide compliant pay slips. Review the FWO’s guidance on record-keeping and make sure your system captures breaks, allowances and higher duties where relevant.

Compliance guardrails built into your workflow

Working under complex awards? Pair approvals with the AI Fair Work Compliance Bot, verify role-based permissions during Onboarding, and track required tickets with Licence & Certification Management.

RosterElf Features That Reduce Risk for Casual Workforces

Roster first, pay right

Build compliant rosters with the right mix of ordinary hours and breaks in Employee Rostering, and surface fatigue and conflict checks. A solid roster is the foundation for clean attendance, correct loadings and fewer payroll exceptions.

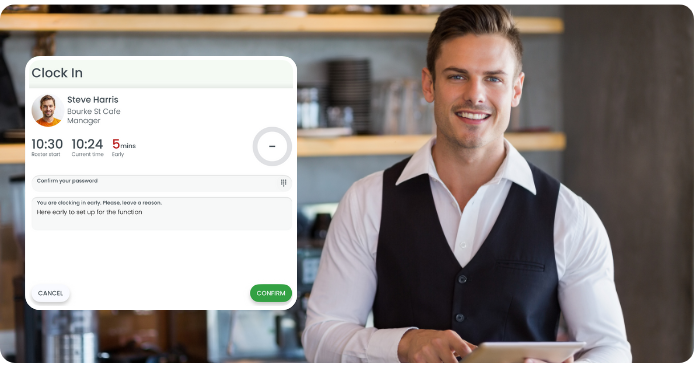

Capture reality with verifiable attendance

Use the Time Clock app and Time & Attendance to record clock-ins, breaks and clock-outs with optional GPS and photo prompts. You’ll have an auditable timeline to support both payroll and workers’ compensation claims.

Automate the tricky bits

RosterElf’s Award Interpretation applies casual loading, overtime, weekend and public-holiday penalties, higher duties and common allowances—then exports payroll-ready data via Payroll Integration.

Stay Fair Work-ready

Use the Fair Work compliance toolkit, keep CEIS and policy documents on file, and align your break and record-keeping practice with the FWO’s guidance.

Cost & Compliance ROI for Australian SMBs

Fewer errors, faster pay runs

Digital capture of hours and breaks eliminates double-handling. Managers stop re-keying timesheets, payroll sees fewer corrections, and employees trust their pay because they can see the same facts you do.

Predictable wage-to-sales ratios

With live attendance, approved timesheets and award interpretation built-in, wage costs stay close to rostered budgets. Exceptions—like extended breaks, late finishes and unplanned overtime—are visible and fixable.

Reduced compliance risk

Award underpayments are costly. Automating casual loadings, penalties and SG rules helps you catch errors before they reach payroll. If challenged, your system provides the documented basis for rates and decisions.

Troubleshooting & Common Mistakes (Quick Wins)

Paying super on the wrong earnings

- Issue: SG paid on overtime or missed on casual loadings.

- Fix: lock in OTE rules in your system; review ATO guidance and run a sample pay run to confirm mapping before you go live.

Confusing casual loading with overtime

- Issue: paying casual loading instead of overtime/penalties.

- Fix: use award rules that automatically uplift overtime/penalty rates for casuals (e.g., 175%, 225%, public holidays), rather than “base + 25%”.

Late SG contributions

- Issue: contributions made after the quarterly due date trigger SGC.

- Fix: set calendar reminders and automate super export in your payroll cycle; reconcile contribution receipts each quarter.

Missing CEIS and poor documentation

- Issue: CEIS not provided; poor records of hours and breaks.

- Fix: add CEIS to onboarding and store a copy; use Time & Attendance to build a defensible record.

Unclear status changes (casual → permanent)

- Issue: regular, ongoing hours but no process for reviewing casual status.

- Fix: schedule periodic reviews of patterns of work; document the outcome and any offers or notices issued.

Buyer’s Notes: Software Capabilities Checklist

What to look for in a platform

- Award interpretation: casual loading, overtime triggers, weekend/public holiday penalties, allowances, higher duties.

- Time capture: phone and kiosk options, GPS radius, photo prompts, late/early reasons, offline tolerance.

- Rostering: budget vs roster view, fatigue/conflict checks, open shift bidding, availability management.

- Payroll export: clean earnings lines and leave types to Xero/MYOB; super and allowance mapping; audit logs.

- Compliance guardrails: built-in prompts and checklists; CEIS storage; certifications tracking.

Why integrated beats bolt-on

When rosters, attendance, award interpretation and payroll export live together, there’s less chance for human error. That’s the design principle behind RosterElf Time & Attendance, Rostering and Payroll Integration.

Policies, Templates & Checklists (Casuals)

Casual Employment Policy (AU spelling)

Purpose: ensure casual employees are engaged, rostered and paid correctly in line with Fair Work, applicable awards and superannuation obligations.

Scope: all casual employees and managers at Company Pty Ltd.

Status & documents

- Provide the Casual Employment Information Statement (CEIS) at onboarding and when required later.

- Store employment contracts, CEIS acknowledgement and any status review outcomes.

Rostering & time capture

- Publish rosters in RosterElf Rostering before the period starts.

- Record shifts, breaks and locations using the Time Clock app or Time & Attendance.

Pay, awards & super

- Apply correct award classifications and loadings via Award Interpretation.

- Export approved timesheets to payroll with Payroll Integration.

- Pay SG on OTE and request stapled funds when no fund is chosen (see ATO guidance).

Workers’ compensation & WHS

- Maintain the required policy for your state/territory; publish the incident reporting process.

- Use attendance data to support incident investigations and return-to-work planning.

Staff quick-start (post near kiosks)

- Check your roster in the RosterElf App and arrive ready to work.

- Clock In on your phone (inside the GPS radius) or at the tablet kiosk.

- Use Start Break / End Break on the same device.

- Clock Out before you leave; add a reason if leaving early.

Manager checklist (weekly)

- Review award classification changes and allowances.

- Approve timesheets by exception and export to payroll.

- Reconcile super contributions and check upcoming quarterly due dates.

- Audit CEIS and contract storage; schedule any casual status reviews.

All-in-one toolkit

Keep rostering, attendance and compliance together: Time & Attendance, Rostering, RosterElf App, Leave Management, Onboarding and Licence & Certification Management. Learn more at RosterElf.

About the Author & Editorial Standards

Author: Steve Harris — Workforce Management & Compliance Specialist with roll-outs across hospitality, retail and care; experienced in Xero-connected workflows and multi-site award interpretation.

Reviewed by: Sean Wyse — Head of Payroll Integrations

Last updated: 31 August 2025

How we create content: We combine hands-on implementation experience with current guidance from the Fair Work Ombudsman, the ATO and state regulators. Guides are peer-reviewed by a subject-matter expert and refreshed as laws, awards or best practices change. Ready to simplify compliance? Anchor your workflow in RosterElf Time & Attendance.