Don’t just take our word for it—see why businesses rate RosterElf the clear winner over Deputy and Connecteam. ? Browse verified Xero reviews and start your free 15-day trial today.

Learn more about the full range of rostering software features in RosterElf.

Let RosterElf’s AI (Perfect Match™) create efficient, compliant rosters in seconds — automatically assigning the best available staff while balancing skills, costs, and rules.

Learn more

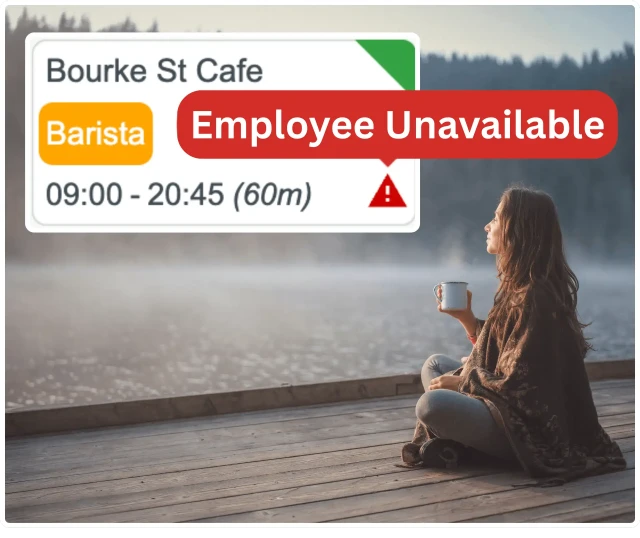

Staff set their own availability and leave requests in the app. Managers approve quickly, and RosterElf prevents clashes automatically when you build rosters.

Learn more

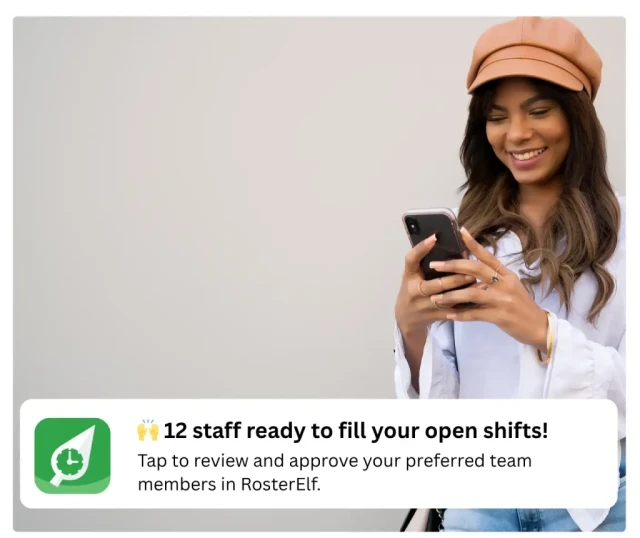

Publish unassigned shifts so qualified employees can claim them from their phones. Fill last-minute gaps fast and keep every shift covered.

Learn more

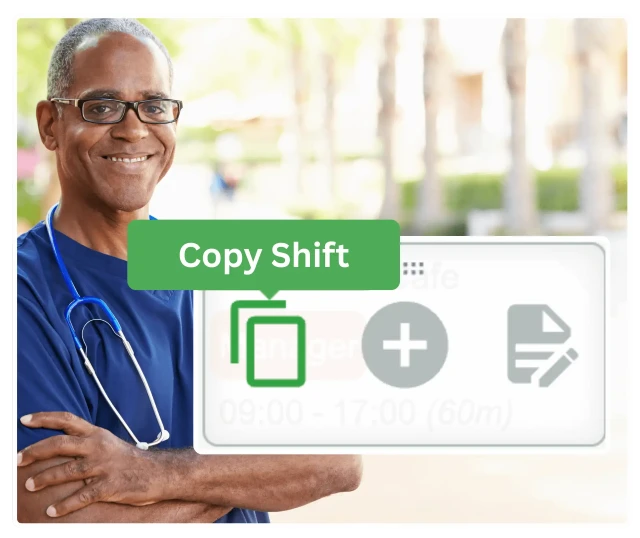

Save time each week with reusable roster templates. Copy, tweak, and publish recurring schedules in just a few clicks.

Learn more

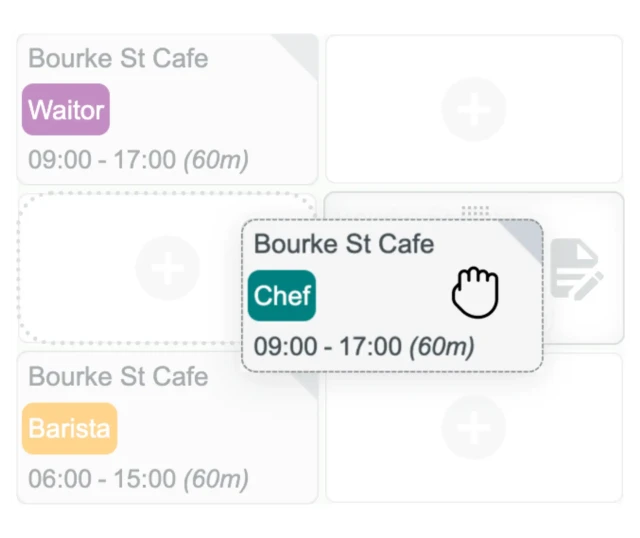

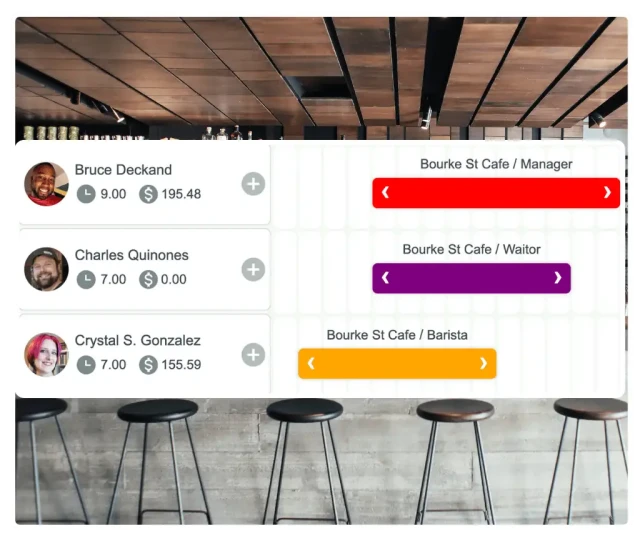

Manage rosters across multiple venues or departments in one place. Switch between sites instantly and track labour costs per location.

Learn more

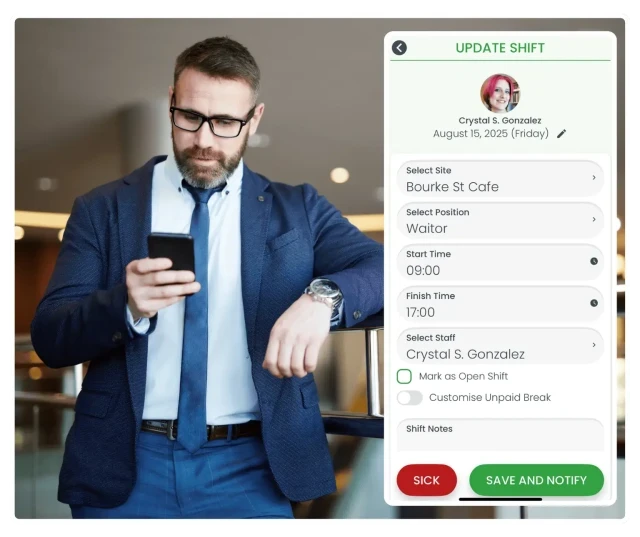

Add and manage paid or unpaid breaks directly within each shift. Stay compliant with award break rules and keep staff coverage consistent.

Learn more

Empower staff to swap shifts easily while keeping manager approval in control. RosterElf ensures only qualified staff trade shifts.

Learn more

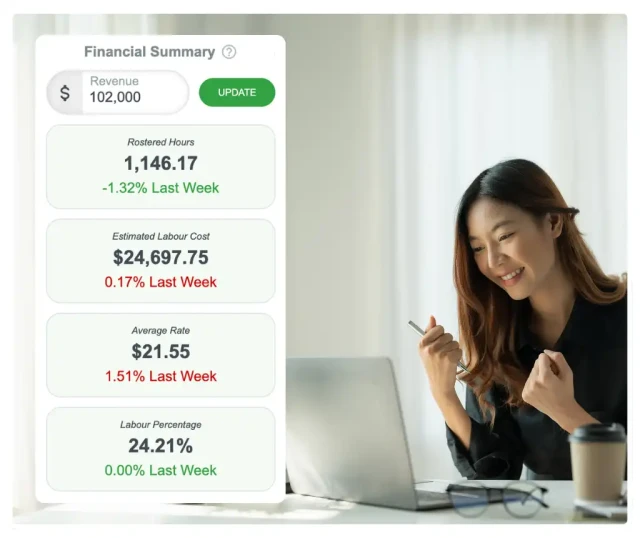

Build rosters to match your wage targets. See live labour costs update as you schedule, helping you stay on budget every week.

Learn more

Manage and publish rosters anywhere. Staff receive instant updates, view shifts, and confirm availability directly from their phones.

Learn more

Review and export detailed roster and labour reports. Track cost trends, hours worked, and budget performance over time.

Learn more

Switch between daily details or a full month overview. Plan efficiently and stay on top of staffing needs across every timeframe.

Learn more

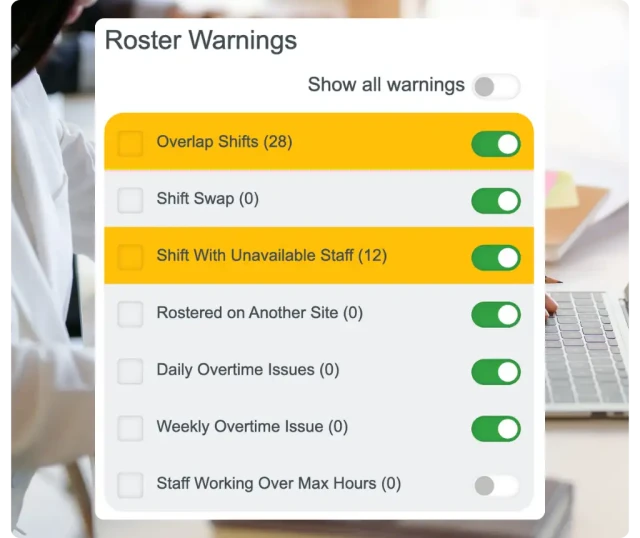

Get instant alerts for coverage gaps, fatigue risks, or overtime before you publish — helping you fix issues and stay compliant.

Learn moreRostering software, also known as staff scheduling software, is a digital system designed to plan, create, and manage employee work schedules more efficiently. It replaces manual scheduling tools like spreadsheets or whiteboards with smart automation that considers staff availability, skills, and business needs.

The main goal of rostering or scheduling software is to save time, reduce human error, and ensure every shift is covered. Managers can build rosters in minutes, automatically match employees to roles, and avoid conflicts or unapproved overtime. The software often includes built-in labour budgeting and award compliance rules, helping businesses stay on top of costs and Fair Work obligations.

Modern rostering and scheduling tools connect directly with employees through mobile apps. Staff can instantly view their schedules, request time off, update availability, or swap shifts with approval. Any roster changes made by managers are updated in real time, keeping communication clear and consistent across the whole team.

Beyond scheduling, most rostering systems integrate with time and attendance tracking and payroll software such as Xero or MYOB. Once shifts are worked and approved, hours flow automatically into payroll, eliminating manual data entry and improving accuracy.

The result is less admin, better cost control, and happier staff. Businesses gain visibility over staffing levels, attendance, and wage costs across one or many locations, while employees enjoy transparent, predictable scheduling.

In short, rostering or scheduling software automates how businesses plan, communicate, and manage shifts. It turns complex staffing tasks into a streamlined process that keeps operations running smoothly, reduces compliance risks, and gives managers more time to focus on their people and customers.