The end of the financial year (EOFY) is a busy and important time for businesses in Australia. It's when you must reconcile your financial records, file your tax returns, and plan for the next financial year.

As an employer, you are also responsible for ensuring that your employees' records are up-to-date and that you comply with your legal obligations.

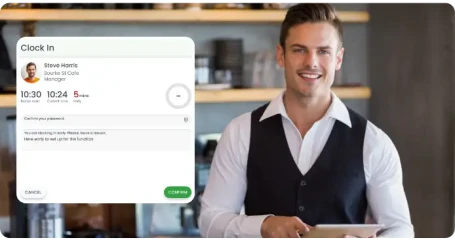

In this blog post, we'll provide you with a guide on how to prepare your business for the EOFY 2023 in Australia and how RosterElf can assist you in the process.

Review Your Financial Records

The first step in preparing for the EOFY is to review your financial records. RosterElf's easy-to-use payroll and employee management software can help streamline this process, allowing you to manage your employees' timesheets and payroll easily. RosterElf can also help you with the following:

-

Checking that your records are accurate and up-to-date: With RosterElf, you can easily track employee attendance, leave requests, and other payroll data. This ensures that your accounting records are accurate and up-to-date.

-

Reconciling your bank statements and accounting records: RosterElf integrates with various accounting software, such as Xero, allowing you to easily reconcile your bank statements and accounting records.

-

Reviewing your payroll records and employee superannuation payments: With RosterElf, Xero and our Xero integration, you can quickly generate payroll reports and track superannuation payments for your employees. This ensures that your payroll records are accurate and up-to-date.

File Your Tax Returns

The second step in preparing for the EOFY is to file your tax returns. This can be a complicated process, but it's essential to ensure that you comply with your legal obligations and that you're not overpaying or underpaying your taxes. Here are some of the things you'll need to do:

-

Lodge your Business Activity Statement (BAS): With RosterElf's integration with Xero’s accounting software, you can easily lodge your BAS and report your GST obligations for the financial year.

-

Complete your annual tax return: RosterElf's payroll reports can assist you in completing your annual tax return, as they provide accurate and up-to-date information on your employees' payroll data, such as business income, deductions, and allowances.

-

Claim deductions and allowances: Make sure you claim all the deductions and allowances you're entitled to. This can help reduce your tax bill and ensure you're not overpaying your taxes.

Benefit from RosterElf's payroll integration

Our payroll integration will help your business boost efficiency, reduce labour costs, and ensure your employees are paid for their work hours. This way, you always stay Fair Work compliant.

There is no need to enter data manually. Simply approve payroll within RosterElf and then export timesheets directly to the third party of your choice.

Did you know? We are the best-rated Xero payroll integration! We have put together a step-by-step guide to help you set up payroll.

Do you need help with the setup? Book a quick call with our team:

Plan for the Next Financial Year

The third and final step in preparing for the EOFY is to plan for the next financial year. This is an important step as it can help you set your business up for success in the year ahead. Here are some things you should consider:

-

Review your business goals and objectives: RosterElf's rostering software can help you align your staffing needs with your business goals and objectives. Creating a roster plan that considers your business goals ensures you have the right staff to achieve them.

-

Prepare a budget and cash flow forecast: RosterElf's rostering software can also help you prepare a budget and cash flow forecast for the next financial year. You can plan for potential cash flow issues and future expenses by forecasting your staffing needs and costs.

-

Assess your staffing needs and create a roster plan: RosterElf's rostering software allows you to easily manage employee schedules and availability, ensuring that you have the right number of staff in place and that you're not over or understaffed.

By reviewing your financial records, filing your tax returns, and planning for the next financial year, you can set your business up for success in the year ahead. Remember to seek professional advice from a registered tax agent if unsure about your legal obligations or financial matters.

With RosterElf's powerful software tools, preparing for the end of the financial year in 2023 has never been easier for Australian businesses. From managing employee records and payroll to filing tax returns and planning for the next financial year, RosterElf streamlines the process and saves you valuable time and effort.

By utilising RosterElf's features, you can ensure that your business is compliant, financially stable, and poised for success in the year ahead.

Learn more about RosterElf and staff management in our blog.