Understanding and following the rules in private equity firms can take time and effort. In the fast-moving world of private equity, where things are high-stakes, and regulations are constantly changing, it's crucial to follow the rules and reduce risks to ensure the firm does well and keeps going. Dealing with these challenges requires an excellent tool to make things easier.

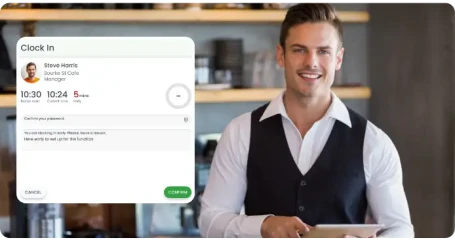

RosterElf was created for businesses, especially in the private equity sector, so it understands their unique needs. Its HR software makes everything easier, helping businesses keep track of all the rules they have to follow, better manage risks, and handle all the regulations.

What Is the Role of HR Software in Compliance and Risk Management

HR software is essential for optimising compliance management and minimising potential risks, particularly within Private Equity (PE) firms that operate under intense scrutiny and strict regulations. Let's explore how HR software functionalities can improve compliance and risk management.

The HR Software Capabilities in Compliance Management

- Simplified Compliance Tasks: Enhance efficiency by automating repetitive tasks like tracking employee certifications, training completions, and regulatory deadlines to prevent oversights.

- Legislation Updates: Stay updated about employment law and regulations with HR software that automatically updates compliance requirements, reducing the risk of non-compliance penalties.

- Document Management: Centralise and safeguard employee documents and contracts to facilitate accessibility during internal audits and compliance checks, ultimately making the compliance process more efficient.

How HR Software Mitigates Risks in PE Firms

- Centralised Risk Monitoring: Establish a centralised dashboard that provides real-time compliance and risk metrics monitoring, empowering private equity firms with actionable insights to address and minimise risks effectively.

- Due Diligence and Integration: Ensure all compliance standards are met to minimise legal and financial risks during the due diligence process and integration of new acquisitions.

- Data Security and Privacy Compliance: It is paramount to follow data protection laws and privacy regulations. By incorporating strong security protocols and compliance tools into HR software, we can ensure the protection of sensitive information and decrease the risk of data breaches.

HR software can help PE firms and other organisations take a proactive approach to managing regulatory challenges. HR software can significantly reduce the burden of compliance management by automating compliance tasks, centralising risk monitoring, and ensuring data security.

Compliance Challenges in PE Firms with HR Software

In private equity (PE) firms, it is crucial to effectively address compliance challenges. This section explores how HR software provides creative solutions to simplify compliance procedures, reduce risks, and guarantee adherence to regulations, all while improving overall operational efficiency.

Complexity of Compliance Jurisdictions

- Private Equity (PE) firms face numerous compliance challenges. These challenges arise from various regulations that differ from country to country, state to state, and city to city. As a result, ensuring adherence to legal standards becomes a daunting task.

- The jurisdiction's complexities include variations in labour laws, tax obligations, employee rights, and privacy regulations.

- The ever-changing nature of these regulations adds another layer of complexity to compliance. As laws evolve and new ones are introduced, private equity firms must constantly stay informed and updated to avoid incurring substantial penalties.

HR Software Solutions to Navigate Jurisdictional Complexities

- RosterElf and other HR software solutions offer adaptable features that cater to the specific compliance requirements of various jurisdictions. These features include automated award interpretation, integration with payroll systems, and secure data management.

- This software simplifies the compliance process by automating complex calculations and guaranteeing that it always follows the latest regulations. It decreases the chances of facing penalties for failure to comply with the rules.

- HR software solutions offer insightful reporting tools, helping PE firms proactively address compliance challenges.

- HR software streamlines compliance for private equity firms. It provides a competitive edge by promoting efficient, compliant operations in various locations, safeguarding the firm from legal liabilities, and improving operational effectiveness.

What Are the Legal Considerations for HR Software

Private Equity (PE) firms operate within an intricate and diverse legal and regulatory environment across different jurisdictions. To navigate this complexity, these firms must employ HR software that complies with various regulatory requirements. Below, we outline vital points concerning the legal frameworks affecting PE firms and the critical role of adaptable HR software:

Legal Frameworks Affecting PE Firms Across Jurisdictions

- Diversity in Regulations: Private equity firms operate worldwide, and laws concerning employment, taxation, and data protection can differ greatly in different regions.

- Compliance Requirements: Businesses must navigate regulations encompassing labour laws, anti-discrimination measures, and privacy policies, all of which have the potential to influence their day-to-day operations, employee relations, and financial decisions.

- Cross-Border Challenges: Understanding and abiding by the legal mandates in every country where a company has employees or investments can pose a unique challenge for firms with international operations.

The Importance of Adaptable HR Software in Meeting Diverse Legal Requirements

- Flexibility is Key: Flexible HR software tailored to suit the specific legal demands of various locations is highly beneficial. This versatility guarantees that private equity firms adhere to the local laws, regulations, and guidelines.

- Automated Updates and Compliance Tracking: Advanced HR systems offer automated updates that align with the latest laws, reducing non-compliance risk.

- Data Protection: To comply with strict data protection regulations, HR software must guarantee the safe management of personal employee data and implement essential safeguards and privacy measures to ensure security and privacy.

- Integration Capabilities: Adaptable HR software can connect with a wide range of systems, making operations more efficient and guaranteeing that all HR management areas adhere to the necessary laws and regulations.

How to Enhance Risk Management Strategies Through HR Software

HR software is essential for private equity (PE) firms to improve their risk management strategies. This innovative technique leverages real-time data to identify types of risks and strategically plan, revolutionising how firms anticipate and mitigate potential challenges.

Identifying and Mitigating Risks with HR Software

- Human resources software provides private equity firms with powerful tools to identify risks by tracking employee performance, turnover rates, and compliance problems. Combining data from different areas helps create a thorough risk management system that allows for the early detection of operational, financial, and compliance risks. The software's reporting features provide valuable information on trends and patterns, assisting firms in developing focused strategies to address vulnerabilities.

Strategic Planning and Risk Management with Real-Time Data

- HR software reports enable PE firms to manage risks and make strategic decisions effectively. Firms can adjust their strategies promptly and stay ahead of potential challenges by utilising real-time data. These reports also aid in optimising resource allocation, ensuring the firm is prepared for unexpected obstacles without wasting resources. Integrating HR software with other systems provides a comprehensive view of the firm's operations, facilitating better strategic planning by considering both internal and external factors impacting risk.

Integrating HR software into the compliance and risk management frameworks of private equity (PE) firms present unparalleled benefits. RosterElf's HR software emerges as a crucial tool in simplifying complex compliance requirements and strengthening risk management strategies. By automating and streamlining business processes, RosterElf ensures that PE firms adhere to regulatory standards, reducing risks associated with human error and regulatory non-compliance. The agility and efficiency facilitated by RosterElf's HR software empower PE firms to prioritise their bottom line over administrative complexities.