Securing loans is crucial for SME growth in Australia. Understanding and enhancing key factors can markedly boost your loan approval odds. RosterElf software offers a wide range of essential products and services. One is the business management tools to help track and manage. It also improves financial visibility and operational efficiency, contributing to a more robust loan application.

Understanding Your Creditworthiness for SME Loans in Australia

To understand your creditworthiness for SME loans in Australia, you'll need to focus on several key areas:

Creditworthiness: In Australia, creditworthiness reflects a small to medium-sized enterprise's (SME) repayment reliability. Lenders assess this before approving loans.

Key Features for Financial Health Indicators:

- Credit Score: Represents the business's credit history and repayment reliability.

- Debt-to-Income Ratio: Measures the proportion of revenue consumed by debt repayments.

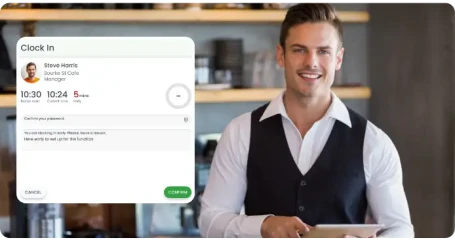

Role of RosterElf software:

- Financial Management: Helps SMEs schedule staff efficiently, reducing unnecessary payroll expenses.

- Boost Credit Scores: Better financial management can improve credit accounts and your credit score.

Financial Health Indicators for Enhancing Loan Approval Odds

Discover how RosterElf optimises financial health management, enhancing your SME's loan approval prospects through detailed financial oversight.

Effective financial health management is vital for SME loan approval.

- RosterElf offers comprehensive services to improve financial oversight, which is crucial for securing loans.

- The tool provides detailed views of labour costs and operational budgets, essential for all types of businesses, including big and small business owners.

- Features include revenue forecasting and labour cost analysis, helping maintain timely payments and a solid financial summary.

- RosterElf enhances visibility into financial performance, showing potential lenders a well-managed financial landscape, thus boosting loan eligibility chances.

Crafting a Strong Business Plan

A robust business plan is crucial for gaining investor trust and navigating the competitive Australian market. RosterElf emphasises the importance of understanding the customer base/preferences and local regulations. A strong business plan identifies market gaps, leverages local resources, and highlights a unique value proposition tailored to the Australian audience.

Critical Role in Loan Approval: A well-prepared business plan is essential in securing loan approvals. Lenders scrutinise the plan to gauge your business idea's viability and financial stability.

Key Elements for Evaluation:

- Market Analysis: Demonstrates understanding of the industry, competition, and target market.

- Business Model: Outlines how your business intends to operate and generate revenue.

- Financial Projections: These provide detailed forecasts of revenue, expenses, and profitability, which are crucial for assessing financial health.

- Enhancing Operations with RosterElf: Utilising RosterElf software can optimise staffing efficiency and management, offering solid, data-backed evidence of operational control and potential growth, which supports claims made in your business idea and business plan.

Collateral for SME Loans

Collateral provides security for lenders when issuing SME loans, offering a way to recoup losses if the borrower defaults. This may include business assets, property, or equipment, with specifics depending on the lender's policies and the loan amount. Properly established collateral reduces lender risk and facilitates loan approval.

Common Types of Collateral in Australia:

- Real estate properties

- Equipment and machinery

- Inventory

- Accounts Receivable

Tips to Leverage Business Assets:

- Regularly assess and update asset valuation.

- Maintain good condition of physical assets to retain value.

- Use comprehensive asset management tools.

Enhancing Collateral Value through RosterElf:

- Inventory Management: Ensure optimal stock levels, reduce costs, and maintain asset value.

- Efficient Scheduling: Align workforce scheduling with business needs, maximising productivity and asset utilisation.

- Reporting Features: Utilise RosterElf's reporting tools to optimise asset performance.

Meeting Industry-Specific Loan Criteria

On RosterElf, meeting industry-specific loan criteria is crucial for securing the financing necessary for business operations. This often involves:

- Demonstrating stable cash flow.

- Providing industry-specific documentation.

- Showing compliance with industry regulations.

These criteria ensure that business processes meet the standard financial requirements and align with their industry's specific operational needs and regulations, enhancing their chances of loan approval and financial success.

Navigating the Loan Approval Process for SMEs

Navigating the loan approval process for SMEs can be daunting, but understanding key steps can simplify it. Here are critical points to consider:

- Prepare thorough financial documentation.

- Build a strong business plan.

- Maintain a good line of credit or a credit score.

These steps are crucial for convincing lenders of your viability and can significantly improve your chances of securing an SME loan.

This loan will support your business’s growth and contribution to Australia's economy.

Strategies for Improving Loan Eligibility

Enhancing your financial profile is crucial to boost your loan chances. Key strategies include:

- Maintaining a solid credit score.

- Demonstrating steady income and profitability.

- Minimising existing debts.

- Offering collateral. Implementing these steps can significantly improve your loan application's appeal to lenders.

The bottom line is that maintaining firm financial profiles through tools like RosterElf is an essential practice for enhancing loan approval odds for Australian SMEs.

Visit rosterelf.com for more tools, and consider professional financial advice to boost your success.