Small businesses in Penrith are realising the benefits of payroll integration. In a thriving local economy, being competitive requires precise financial management. Handling payroll accurately, complying with regulations, and staying cost-effective can be challenging for many small businesses.

RosterElf helps Penrith's small businesses by simplifying payroll tasks. Our tool simplifies wage management, deductions, and super contributions, ensuring accuracy. Crafted with small businesses in mind, RosterElf is a reliable business partner for your day-to-day business operations.

What are the payroll challenges in Penrith

Penrith, a bustling area in Greater Western Sydney, is home to a dynamic community of small to medium-sized businesses. These enterprises contribute to the local economy's growth, yet they frequently face intricate payroll challenges that can impede their overall efficiency. Here, we delve into these companies' primary payroll services issues, emphasising the importance of streamlined payroll management.

- Compliance with local regulations: Complying with the intricacies of local labour laws and taxation requirements in Penrith presents a significant hurdle. Small businesses must remain up-to-date with any modifications in legislation to avoid facing penalties and guarantee adherence. This encompasses understanding the obligations outlined in the Fair Work Act, which governs employees' rights and workplace conditions.

- Time-consuming payroll processes: Despite technological advancements, numerous small businesses in Penrith still depend on manual payroll systems. Manually calculating wages, tax withholdings, and superannuation contributions is not only time-consuming but also vulnerable to human errors. This can hinder allocating time towards essential business activities, such as engaging with customers and striving for service improvement.

- High frequency of errors: Manual payroll procedures are prone to mistakes. Errors in computing overtime, holiday pay, or income tax deductions can result in unhappy employees and possibly expensive disagreements or penalties. For small businesses with limited resources, these mistakes can be especially harmful.

- Cost implications of manual payroll management: Operating manual payroll systems comes with considerable costs for small businesses. These costs involve allocating labour hours to calculations, record-keeping, and the potential consequences of non-compliance, such as penalties. Given the narrow profit margins that many small businesses operate within, these expenses can notably impact their overall profitability.

Small businesses in Penrith need to carefully address these payroll challenges to comply with regulations, keep employees happy, and maintain financial stability. Implementing automated payroll systems can minimise these issues through accurate, compliant, and efficient payroll management.

RosterElf and its features

RosterElf streamlines scheduling and payroll processes for small to medium-sized businesses. This software can improve your business operations by consolidating essential functions like scheduling, time tracking, and payroll into a single, easy-to-use platform. Here's how RosterElf can transform your business operations:

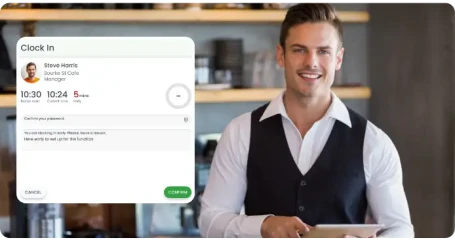

- Accurate time tracking: RosterElf provides a convenient digital time clock feature that greatly simplifies monitoring employee working hours. Using this feature significantly reduces the need for manual effort, resulting in fewer errors when inputting payroll data. The timesheets are constantly updated with the latest payroll information, ensuring that payroll calculations are precise and hassle-free.

- Easy scheduling: The software offers a scheduling interface that is easy to use, allowing you to effortlessly create and adjust employee schedules by simply dragging and dropping. This convenient feature enables swift responses to changes in staffing and ensures effective workforce management. Making scheduling easy helps businesses maintain operational efficiency and effectively meet diverse demands without facing the problems of having too many or too few staff members.

- Integration with payroll software: RosterElf smoothly connects with well-known payroll software, making financial management more efficient. This connection simplifies payroll by automatically matching employee hours and pay rates with accounting, guaranteeing that payroll records are constantly accurate and current.

- Compliance with Fair Work regulations: RosterElf includes unique features to help you run your businesses while following Fair Work regulations, which are essential for staying compliant and creating a safe work environment.

- Cost-effective resource management: RosterElf offers a solution that significantly benefits small businesses. Automating critical processes effectively reduces administrative costs and optimises labour spending. This is particularly advantageous for small businesses that must carefully manage payroll and resource allocation to maintain profitability.

RosterElf is a crucial tool for small businesses. It provides advanced payroll software solutions that tackle complicated payroll issues with cutting-edge technology and user-friendly design.

How to maximise the benefits of payroll integration with RosterElf

Making the most of payroll automation can give you a competitive edge. By utilising RosterElf's analytics and frequent updates, you can simplify your financial processes and improve your decision-making. Here are some ways you can use these tools to get the best results:

- Utilise RosterElf reporting for strategic financial planning: Explore the reporting capabilities of RosterElf to delve into labour expenses, overtime patterns, and payroll inconsistencies. This information is vital for predicting budgets and allocating resources effectively, empowering you to make well-informed financial choices that enhance the efficiency of your business.

- Regular system check-ins: It is essential to make it a regular practice to monitor the system's performance. This will keep you updated with the latest features and enable you to adapt to any changes in payroll regulations quickly. Taking a proactive approach with these check-ins can prevent potential issues and optimise your payroll management process.

- Stay updated with payroll system updates: RosterElf updates its software to enhance its performance and ensure compliance with the latest payroll laws. By keeping your system current, you guarantee that your payroll processes are efficient and meet Australian standards.

- Leverage ongoing support: RosterElf provides reliable customer service support for any queries or issues that arise. Whether you need assistance troubleshooting a problem or understanding new features, the dedicated team at RosterElf is always available to ensure that your payroll operations run smoothly without interruptions.

- Engage with new features: When updates are released, take the time to learn about and include any new features in your payroll procedures. These enhancements are intended to streamline your workflow, enhance accuracy, and ultimately save you time.

The advantages of RosterElf for small businesses in Penrith are undeniably apparent. This software streamlines the payroll processing system, eliminating common obstacles and simplifying complex tasks with its robust integration capabilities. By embracing RosterElf, local enterprises can manage labour costs, seamlessly comply with Fair Work regulations, and save valuable time and money.

If you're a business owner in Penrith and struggling with payroll management, it might be time to assess your current systems. Take a moment to consider the significant improvements and efficiency gains you could achieve with RosterElf. Don't let outdated processes hinder your business growth. Contact RosterElf today to schedule a demo or consultation and see firsthand how we can customise our payroll solutions to fit your unique needs. It's time to leave behind the complexities of payroll management and embrace a more streamlined future!