Read what our clients have to say about us

See all reviewsAutomatically syncs timesheets and attendance data with payroll systems, reducing manual data entry and minimising errors.

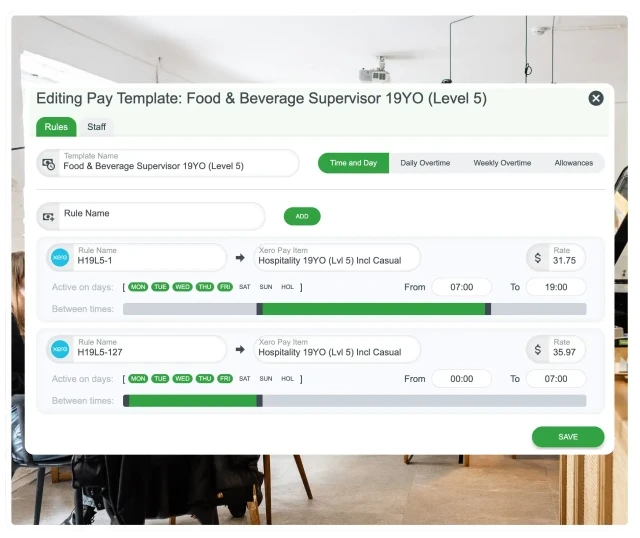

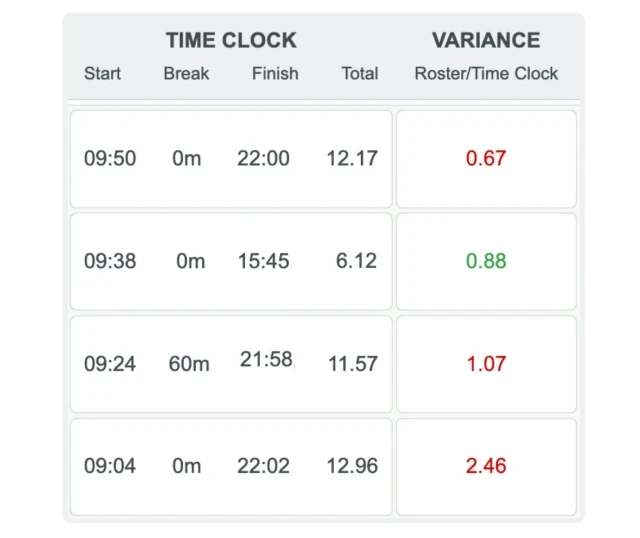

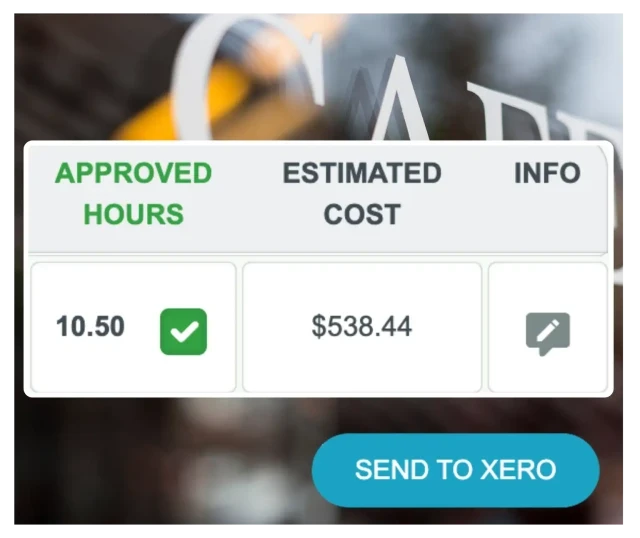

Ensures precise calculations of wages, deductions, and overtime by directly integrating award interpretation and compliance into payroll.

Saves valuable time by automating the payroll process, allowing managers to focus on other critical tasks instead of manually managing payroll.

Keeps up with the latest labor laws and award regulations, ensuring that payroll calculations are compliant with current rules.

Provides up-to-date and accurate payroll information, enabling timely and efficient payroll processing.

Lowers the costs associated with manual payroll management and potential errors, leading to overall cost savings for the business.

Experience an intuitive interface that simplifies payroll and rostering tasks, making management easier.

Manage your payroll and rosters on the go with our user-friendly mobile apps, ensuring flexibility and convenience.

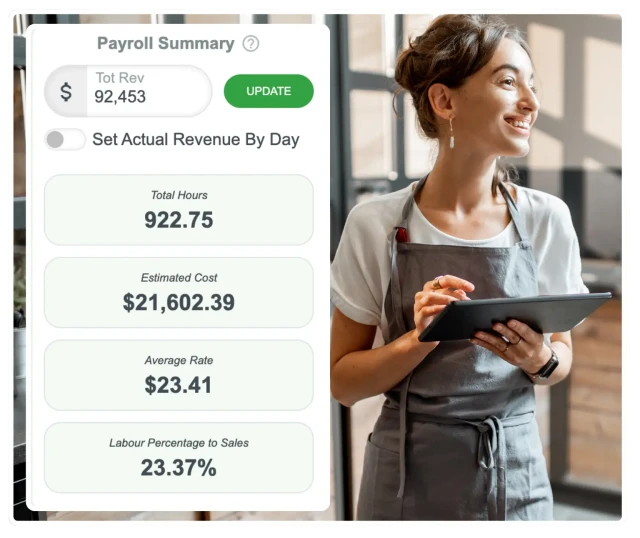

Track costs, labour percentages, and hourly rates in real-time, helping you make informed financial decisions.

Enhance team communication by sharing rosters instantly and managing last-minute changes effortlessly.

Easily handle shift swaps and open shifts, ensuring smooth operations and better employee satisfaction.

Create and reuse roster templates, streamlining the scheduling process and saving valuable time.

Leave Management software questions? We have the answers