Did you know that many small to medium-sized businesses in Australia face significant challenges due to inadequate payroll management systems? The complexity of Australian tax laws and Fair Work regulations demands precision and understanding that a manual or outdated system cannot provide.

Modern payroll management systems provide a sense of security. These systems simplify processes and reduce risks by ensuring compliance with Australian tax laws and Fair Work regulations. This allows business owners to dedicate more time to expanding their businesses and fostering innovation. Ultimately, these systems act as a valuable tool that protects your business from legislation and payroll management challenges.

This blog will discuss the importance of upgrading to an efficient payroll management system and emphasise how it can positively impact your business in the long term.

Why Your Business Needs a Payroll Management System

Ensuring efficient payroll management is essential for small to medium-sized businesses in Australia. Utilising a payroll management system provides many advantages that streamline payroll reports and procedures, and uphold compliance with Australian legislation. Let's examine the benefits of incorporating a payroll system into your business operations.

- Time Savings: A payroll system provides several benefits, and one of the most immediate ones is the significant time saved for business owners and HR departments. Manual payroll processing is a time-consuming task requiring calculations and data entry hours. However, implementing a payroll management system allows these processes to be automated, freeing up valuable time.

- Enhanced Accuracy: Payroll mistakes can have significant financial consequences, causing dissatisfaction among a number of employees and potentially leading to legal challenges. A payroll system helps minimise these risks by automating the calculations for wages, taxes, superannuation, and other deductions, ensuring accuracy and reducing human errors.

- Compliance with Australian Laws: Managing payroll compliance in Australia can be challenging due to various factors such as tax laws, superannuation contributions, and Fair Work regulations. A payroll management system is specifically designed to ensure that businesses adhere to these legal requirements and avoid penalties. This system automatically tracks the latest rates and rules, always ensuring compliance.

- Improved Security: Ensuring the security of payroll information is of utmost importance and cannot be taken lightly. Payroll systems have advanced security features to prevent unauthorised access or fraudulent activities. These systems store data in secure and encrypted formats, guaranteeing that only authorised personnel can access it.

- Access to Real-Time Data: A payroll management system provides businesses with up-to-date information on payroll data expenses, tax responsibilities, and other financial measurements. This immediate access to data enables better decision-making, budgeting, and financial planning.

- Seamless Integration with Other Systems: Many payroll systems can integrate with other business software solutions, such as time tracking, HR management, and accounting software systems. This integration facilitates a seamless data flow across platforms, reducing manual data entry and increasing operational efficiency.

Key Features to Look for in a Payroll Management System

When deciding on a payroll management system, it is vital to consider key features that can automate payroll processes, ensure adherence to regulations, and boost employee satisfaction. Here is an overview of the essential features when choosing a payroll system.

- Tax Updates: An advanced payroll system will update itself with Australia's most recent tax rates and laws. This is important for ensuring that taxes and superannuation are calculated correctly, which helps save time and lowers the chance of mistakes.

- Employee Self-Service Portal: Providing employees with a self-service portal allows them to check their payslips for specific pay periods, ask for time off, and modify personal details independently. This helps make things clearer, lessens the amount of administrative tasks, and boosts employee happiness.

- Integration Capabilities: Seamless integration helps streamline workflows, ensure data consistency, and simplify reporting, ultimately enhancing payroll management efficiency.

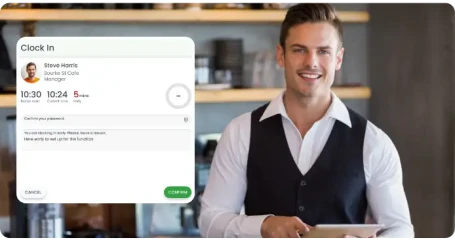

- User-Friendly Interface: A simple-to-use system helps new users learn faster and make fewer mistakes. With a user-friendly interface, individuals with little payroll expertise can efficiently complete payroll tasks.

- Scalability: As your company expands, it is important that your payroll system can expand alongside it. Scalability guarantees that the system can manage more intricate payroll needs without requiring a complete system revamp as the business grows.

- Support for Australian Tax and Superannuation Calculations: It is vital to have extensive support for local tax and superannuation calculations. The system should be personalised to meet the specific requirements of the Australian Taxation Office (ATO) and superannuation regulations, ensuring precision and compliance.

- Mobile-Friendly Design: A mobile-friendly payroll system is essential. This feature allows managers and employees to access payroll information and complete tasks from any location and time, providing convenience and flexibility.

- 24/7 Support: Continuous support is vital for promptly resolving issues and ensuring payroll procedures run smoothly. Dependable customer service offers peace of mind and aids in sustaining business operations.

How to Evaluate and Choose the Right System

Selecting the right payroll software is crucial to avoid unnecessary troubles and costs. A systematic approach to making an informed decision is important. This step-by-step guide will assist you in choosing a payroll system that caters to your business's specific requirements.

- Set a Budget: Before you commence your search, it is essential to determine the amount you are willing to invest in payroll software. Remember that the cheapest option may only sometimes offer the best functionality and support.

- List Must-Have Features: Write down the essential features for your purposes, such as interpreting awards, managing leaves, calculating superannuation, and integrating with payroll. This will enable you to efficiently eliminate systems not meeting your specific criteria.

- Compare Providers: Examine the offerings of different providers and assess how well their systems have worked for other businesses. It is important to give special consideration to reviews, especially those from companies similar to yours in size and industry.

- Trial the Software: Most vendors provide a free trial to assess how well the software aligns with your company's procedures. Evaluate its user-friendliness, the effectiveness of customer support, and any features that may be absent.

- Consult a Professional: Consult with an accountant or business advisor before making a final decision. They can provide valuable input on the system's compliance with Australian tax laws and suitability for your operational needs.

Top Payroll Systems for Australian Businesses

Australian businesses in 2024 have a variety of payroll systems to choose from. These systems are designed to help with processing payroll, ensure everything is done correctly, and save time. Here is an unbiased overview of top payroll software platforms, offering Australian businesses the information they need to choose wisely.

1. Xero Payroll

- Features: Automatic tax and super calculations integrate seamlessly with Xero accounting.

- Pros: Smooth integration with accounting, easy to use.

- Best For: Small to medium-sized businesses looking for integrated accounting and payroll.

2. MYOB Payroll

- Features: Automatic tax updates, superannuation processing, and employee self-service portal.

- Pros: Comprehensive features integrated with MYOB's accounting services.

- Best For: Businesses already using MYOB accounting solutions seeking integration.

- Features: Direct deposit, automatic tax calculations, and compliance management.

- Pros: Easy integration with QuickBooks accounting, mobile app for on-the-go management.

- Best For: QuickBooks users needing a simple, integrated payroll solution.

4. Keypay

- Features: Automated pay runs, award interpretation, and employee self-service.

- Pros: Powerful automation and compliance features.

- Best For: Businesses of all sizes need comprehensive payroll and workforce management.

- Features: Integrated timecards, tax filings, and employee payments.

- Pros: Simple pricing structure, easy to use.

- Best For: Small businesses and those already in the Square ecosystem.

Finding the appropriate payroll management solution is crucial for any business striving for compliance, efficiency, and employee contentment. In this article, we have delved into the advantages of an efficient payroll system, such as adhering to Fair Work regulations and streamlining payroll procedures. Integrating a payroll system that suits your business requirements minimises the risk of non-compliance and cultivates a favourable work environment where employees benefit from correct and punctual payments.