In the Australian workplace, navigating the complexities of award interpretation is crucial for employers to ensure fair wages, compliance with labour laws, and a harmonious work environment. However, understanding the intricacies of award interpretation can be daunting for many employers.

This comprehensive guide will demystify Australian award interpretation, shedding light on critical concepts, compliance requirements, and best practices to help employers confidently manage their workforce and payroll processes.

Understanding Australian Awards

Australian awards are legally binding documents that outline the minimum pay rates, working conditions, and other entitlements for employees within specific industries or occupations. Each award is tailored to the requirements of its respective sector, ensuring that employees are treated fairly and consistently across the country.

To navigate award interpretation effectively, employers must identify the relevant award that applies to their employees' roles. This can be determined based on the industry, occupation, or specific job duties performed.

Key Concepts in Award Interpretation

a. Base Rates: Awards specify the minimum base rates of pay for various job classifications. Employers must ensure all employees are paid at least the applicable base rate for their roles.

b. Penalty Rates: Penalty rates are additional employee payments for working outside standard hours, such as evenings, weekends, or public holidays. Understanding the specific penalty rates that apply to each award is essential.

c. Overtime: Awards outline rules for overtime pay, which is usually paid when employees work beyond their standard hours or weekly thresholds.

d. Allowances: Some awards provide additional allowances for specific work-related expenses, such as travel or meal expenses.

Compliance with Labor Laws

Complying with award interpretation is not optional; it is a legal requirement in Australia. Employers must adhere to the terms and conditions outlined in the relevant award to avoid penalties, disputes, and potential legal repercussions.

Regularly reviewing award requirements and seeking legal advice, if necessary, can ensure compliance and mitigate risks.

Best Practices for Award Interpretation

a. Keep Accurate Records: Maintain detailed records of hours worked, including start and finish times, break durations, and any additional hours worked beyond the standard schedule.

b. Regularly Review Awards: Awards may be updated or revised periodically. Stay informed about any changes and ensure that your payroll processes reflect the latest award requirements.

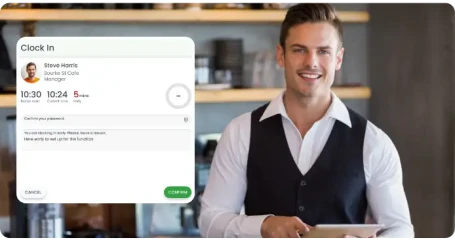

c. Utilize Payroll Software: Investing in reliable payroll software can streamline the award interpretation process, ensuring accurate calculations and reducing the risk of errors.

d. Seek Expert Advice: When in doubt about award interpretation or handling specific employee situations, consult with HR professionals or legal experts to make informed decisions.

Employee Communication and Training

Transparent communication with employees is crucial in award interpretation. Provide clear explanations of how awards affect their pay and entitlements, including penalty rates and overtime policies.

Regular training sessions for HR staff and management can also enhance understanding and consistency in award interpretation practices.

Wrap Up

Australian award interpretation is a vital aspect of workforce management and payroll processes for employers nationwide. By understanding the key concepts, complying with labour laws, and implementing best practices, employers can ensure fair treatment of their employees and maintain a compliant and harmonious work environment.

Staying informed about award updates, investing in efficient payroll software, and seeking expert advice when needed are essential steps to successfully navigate the complexities of award interpretation.

By demystifying Australian award interpretation, employers can foster trust, satisfaction, and productivity among their workforce while upholding their legal responsibilities.