Small business owners must thoroughly understand employment awards to guarantee compliance and fair compensation. The Commercial Sales Award (CSA) not only establishes the minimum wage and employment conditions for employees in the commercial sales sector, covering full-time, part-time, and casual workers, but also plays a crucial role in protecting employee rights. This award details ordinary hours, penalty rates, overtime, and allowances, which helps businesses manage payroll accurately and legally. Familiarising yourself with the CSA ensures that your business adheres to legal standards and supports employee rights.

Overview of the Commercial Sales Award (CSA)

The Commercial Sales Award (CSA) is a significant legislation in Australia that explicitly sets rules for individuals in sales positions. This law, which falls under the Fair Work Commission's Modern Awards, covers essential aspects of employment, including sales representatives and agents.

- Definition and Scope: The Commercial Sales Award (MA000083) protects a diverse range of employees in the sales industry. It is relevant to businesses and individuals whose primary responsibility is selling products and services, regardless of the company's size. This award includes salespeople who visit clients, sales teams working within the company, and individuals engaged in telemarketing.

- Importance for Employers: Small business owners need to understand the CSA well. Compliance with the CSA is essential as it ensures fair treatment of employees and reduces the risk of legal disputes and financial penalties. Following the Award helps to keep employees motivated and legally protected.

- Fundamental Changes and Updates: The CSA undergoes regular updates to adapt to changes in the job market and laws. Employers must stay informed about the latest amendments to ensure they follow the rules. Some recent changes involve minimum wage rates, leave entitlements and working hours. Employers must keep up with these updates to make necessary changes to their payroll and HR procedures.

The CSA is an essential tool for regulating commercial sales employment in Australia. Its extensive coverage and regular updates ensure that employees and employers operate within a fair and legally sound framework.

What Are the Key Clauses of the CSA?

In Australia, the Commercial Sales Award (CSA) provides essential guidelines for individuals in the commercial sales industry. Below is a summary of the key provisions related to minimum wages, employment classifications, working hours, overtime, penalty rates, and rest breaks.

Minimum Wages

- Explanation of Minimum Wage Rates: The minimum wage rates are determined by the employee's classification level and are regularly revised to account for inflation and changes in the cost of living.

- Wage Structure: The type of work payment can be organised as an hourly wage or a weekly salary. Minimum wage rates may differ for junior employees, apprentices, and trainees.

Types of Employment

- Full-Time Employment: Full-time employment is when someone works an average of 38 hours per week. This type of employment comes with benefits such as paid annual leave, sick leave, and public holidays.

- Part-Time Employment: Part-time employees typically work fewer than 38 hours per week and receive the same benefits as full-time employees, but the benefits are adjusted based on the number of hours worked.

- Casual Employment: Casual employment means working hourly without a guaranteed number of hours. You will receive a casual loading of 25% instead of paid leave benefits.

Overtime and Penalty Rates

- Overtime: When an employee works over 38 hours a week, or the work arrangement hours, they'll start earning overtime. They'll be paid 150% of your average rate for the first 2 hours and 200% for any additional hours.

- Penalty Rates: Penalty rates are applied for weekend work, with a 150% increase for Saturdays and a 200% increase for Sundays. On public holidays, the rate is 250%. Late-night shifts also come with additional loading.

Breaks and Rest Periods

- Meal Breaks: Following 5 hours of work, employees can take a 30-minute unpaid meal break.

- Rest Breaks: Employees are given short paid breaks of 10 minutes for every 4 hours. Longer shifts include additional breaks to ensure the well-being of the employees.

These clauses ensure fair and structured working conditions for employees covered under the CSA, promoting a balanced and regulated working environment. For more detailed information, refer to the official CSA documentation and guidelines.

Entitlements Under the CSA

The CSA includes clauses that ensure employees have fair and structured working conditions, which help maintain a balanced and regulated work environment.

Leave Entitlements

- Annual Leave: Employees accumulate four weeks of annual leave per year. They may take this leave with mutual agreement between themselves and their employer, provided operational needs are satisfied.

- Personal/Carer’s Leave: Employees can take ten days of paid personal/carer's leave each year. If absent for over two consecutive days a week, a medical certificate is required.

- Parental Leave: Employees with at least 12 months of continuous service are eligible for parental leave. They can take up to 12 months of unpaid leave and request an additional 12 months if needed.

Allowances and Reimbursements

- Types of Allowances: Employees may receive various allowances, such as travel allowances, designed to cover travel expenses during work duties. Another type is the uniform allowance, provided to assist with the cost of purchasing uniforms required by the employer.

- Conditions: When certain conditions, like travel requirements or uniform needs, are fulfilled and confirmed, employees can receive these benefits.

Termination and Redundancy

- Notice Periods: Employers must give employees a notice period that depends on how long they have been working for the company. This notice period usually lasts between one to four weeks.

- Redundancy Pay: Employees receive redundancy pay based on their length of service, ranging from 4 weeks' pay for one year to a maximum of 16 weeks' pay for nine or more years.

Superannuation

- Employer Obligations: Employers must deposit money into a complying superannuation fund for their employees.

- Calculation and Payment: Superannuation is a percentage of the employee's usual earnings and must be distributed at least once every quarter.

Practical Tips for Employers

Keeping up to date with the Commercial Sales Award (CSA) is essential for upholding compliance and promoting a just workplace. Below are some practical suggestions to aid employers in efficiently managing their responsibilities.

Staying Updated

- Resources for keeping up-to-date with changes in the CSA: Visit the Fair Work Commission website for the latest updates. Subscribe to newsletters from reputable employment law firms or HR organisations. You can also join industry associations that provide updates and training on award changes.

- Importance of regular training and updates for HR staff: Plan regular training sessions to keep HR staff updated on the latest CSA amendments. Utilise online courses and webinars for ongoing education. Establish a knowledge-sharing platform within the HR team to review recent changes and their impact.

Utilising Technology

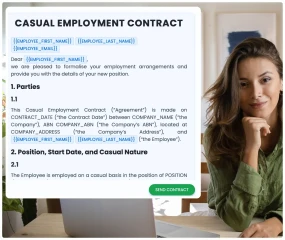

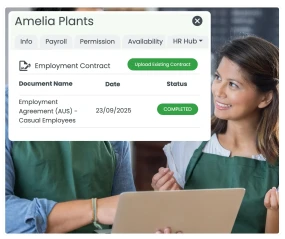

- How technology can assist in managing compliance: Use rostering software to ensure schedules follow award conditions, such as breaks and maximum hours. Additionally, consider utilising modern payroll systems that can adjust based on the most recent CSA rates and conditions.

- Benefits of integrating award interpretation tools: These tools help understand complex award requirements and automate compliance checks. By streamlining the calculation of entitlements and penalties, they reduce manual errors and save time.

Seeking Professional Advice

- When and why to consult with employment law professionals: Ask for guidance when making significant policy changes or dealing with complicated compliance issues. Seek help from experts when disagreements arise or when you need clarification on unclear award conditions.

- Resources for additional support and information: Seek assistance from employment law firms for personalised guidance. Utilise online HR platforms such as RosterElf for tools to ensure compliance and expert advice.

The Commercial Sales Award (CSA) contains crucial information about standard working hours, overtime, penalty rates, and allowances for full-time, part-time, and casual employees. Understanding these entitlements is essential for complying with legal obligations. Keeping up to date with the CSA is vital for ensuring fair employee compensation and steering clear of legal issues. Use available resources and seek professional guidance to navigate these complexities effectively.