Cottesloe, a coastal suburb of Perth in Western Australia, is renowned for its picturesque beaches and thriving community. It is also recognised as a hub of entrepreneurship, where small businesses significantly drive the local economy. Operating on a seasonal business model, these businesses often face unique challenges in efficiently managing their workforce and payroll processing. Efficient payroll systems are critical for maintaining financial stability, ensuring regulation compliance, and fostering employee satisfaction.

Over time, payroll systems have changed. In the past, people had to write everything down and do the math manually. But now, small businesses in Cottesloe have found better ways to handle their payroll. They use systems that make managing employee hours, wages, and superannuation contributions much easier. It also helps them follow all the rules about employment in Australia.

Using digital platforms for payroll simplifies things and gives an advantage by eliminating time-consuming tasks and saving resources. This is especially important in Cottesloe because it helps small businesses including handling peak tourist seasons.

What Are the Unique Payroll Needs of Cottesloe's Small Businesses

The distinct location and seasonal aspect of tourism in Cottesloe create specific payroll difficulties. Let's explore these challenges and how to manage them successfully.

Seasonal Staffing

- Challenge: Many businesses in Cottesloe depend on hiring extra staff during the busy tourist seasons. Since the number of staff needed can change significantly during these times, businesses need help managing their payroll. They often must adjust their payroll systems to ensure they're paying everyone the right amount.

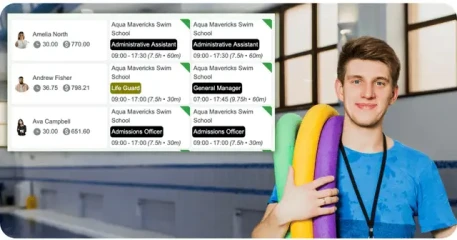

- Management Tips: To ensure you have the correct number of employees for your day-to-day business operation, looking at roster data from similar periods is a good idea. Consider using a payroll system that can easily adjust to changes in staffing needs. A workforce management tool like RosterElf can also help simplify adding or reducing employees on your payroll.

Beachfront Business Operations

- Challenge: Running a business near the beach has its unique difficulties. One of them is the risk of sand and water causing harm to important payroll documents or electronic devices used for processing payroll.

- Management Tips: Switching to cloud-based payroll systems can help protect your records from getting damaged and ensure you can access payroll information from anywhere. Remember to back up your data often to avoid losing anything important.

Cottesloe Business Regulations

- Challenge: For new or small businesses, it can be challenging to comply with the specific requirements of the local regulatory environment, particularly about payroll. This is especially true for those unfamiliar with the Fair Work regulations and the various local taxation laws that must be followed.

- Management Tips: To ensure your business follows the rules and regulations in your area, it's a good idea to check with your local Chamber of Commerce or a business advisor. You can also use payroll software set up to follow Australian regulations, which will help you stay compliant without manually checking everything.

Small businesses in Cottesloe face unique challenges when managing their payroll. But with the right strategies in place, they can survive and thrive. One critical approach is to embrace technology and seek out local expertise to navigate the complexities of payroll management in this dynamic coastal town.

The Role of Technology in Transforming Payroll Systems in Cottesloe

Technology is changing things in many ways. It helps business owners handle payroll better, ensuring employees get paid correctly and promptly. Let's see how technology is making payroll management better.

- Real-Time Data Access: Cloud-based solutions provide a significant advantage to businesses by allowing them to access data in real time. Managers rely on the newest information to keep their payroll accurate and current.

- Automated Tax Calculations: Small business owners have always found it challenging to calculate taxes. With modern payroll solutions, this process has become more manageable. These solutions automate the tax calculation process without any mistakes and ensure we follow all the tax laws. This automation saves time and resources, which can be used for other business areas.

- Remote Access: Managing payroll systems from anywhere allows managers to monitor payroll operations no matter where they are. With this flexibility, payroll operations can run smoothly and efficiently wherever you are located.

Key Features to Look for in a Future-Proof Payroll System

Small businesses in Cottesloe are thriving by the beach, but managing payroll can be challenging. Investing in a reliable payroll system is essential to keep your business running smoothly. Here are some key features that are perfect for small businesses in Cottesloe.

1. Scalable Payroll Systems: As your company expands, your payroll system should be able to grow along with it without causing any additional setup complexities. A payroll system that can scale up quickly to accommodate more employees and handle seasonal variations effortlessly is ideal for businesses that experience increased activity during certain times, such as the summer months.

2. Compliance with Australian Tax Laws: Navigating the complex laws and regulations regarding Australian taxes can take time. That's why businesses need to prioritise compliance. By adhering to the relevant tax laws, you can avoid costly penalties. With automatic updates to reflect any changes in legislation, you can rest assured that your business will always be compliant.

3. System Integration: Integrating with payroll can save you time and effort. Doing so will give you real-time updates on labour costs, which can help you make better decisions when scheduling your staff. You can automate transferring hours worked into your payroll system, making everything more efficient.

Selecting the right payroll system is crucial for small businesses in Cottesloe. Owners can ensure that their business grows with them by focusing on key features, such as compliance and efficiency. This approach saves time on administrative tasks and allows owners to focus on providing great experiences for locals and tourists.

Overcoming Common Pitfalls in Payroll Management

Dealing with payroll can be quite challenging. With the rules and regulations changing frequently, it's easy to make mistakes. There are ways to avoid these mistakes and manage payroll smoothly. This article will discuss some common payroll management issues and how to overcome them.

1. Data Entry Errors: Whether due to human error or system glitches, incorrect data entry can lead to overpayments, underpayments, and operational issues.

- Avoiding Payroll Errors: Implement systems or automated error checks and regular training for staff to ensure they're up-to-date with the latest software features and data entry practices.

2. Overlooking Compliance Updates: Legislation and compliance requirements can change fast. Missing these updates can result in fines and damage your business's reputation.

- Payroll Compliance Updates: Subscribe to updates from relevant government and industry bodies. Select payroll software that updates automatically in response to new regulations.

3. Failing to Secure Sensitive Payroll Data: Payroll data is a goldmine for cybercriminals. A breach can compromise employee trust and lead to significant legal troubles.

- Secure Payroll Data: Use robust data security measures like multi-factor authentication. Regularly review and update security protocols to combat evolving cyber threats.

Small businesses in Cottesloe realise the importance of adopting tech-driven payroll systems to boost efficiency. By utilising advanced solutions, businesses can simplify operations, adhere to compliance regulations, and save time and cash flow for the long term.

To remain competitive and efficient, local businesses must embrace these advancements. Assessing your current payroll system and considering an upgrade are the first steps toward future-proofing your operations. Feel free to consult with payroll technology experts for personalised advice, ensuring your business is well-equipped to navigate the evolving landscape of payroll management.