RosterElf has become the go-to rostering solution for thousands of Australian businesses. From hospitality to retail, healthcare to clubs, we’ve built our platform specifically to meet the challenges of running teams under Australia’s workplace laws. Here are three reasons why RosterElf is recognised as the best rostering system in Australia:

Don’t just take our word for it—see why businesses rate RosterElf the clear winner over Deputy and Connecteam. 👉 Browse verified Xero reviews and start your free 15-day trial today.

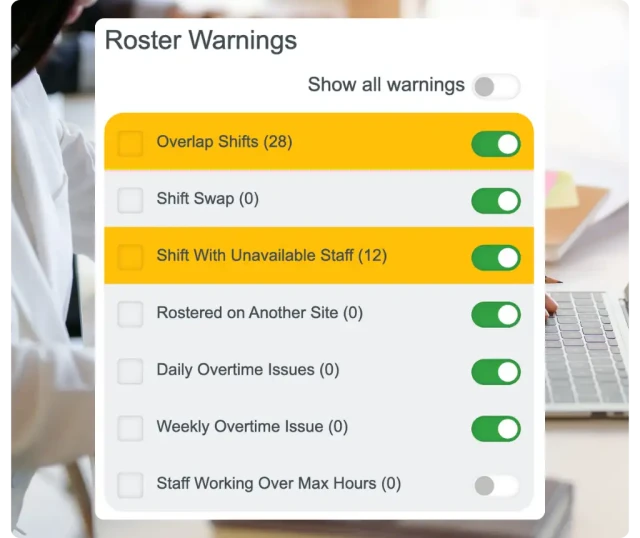

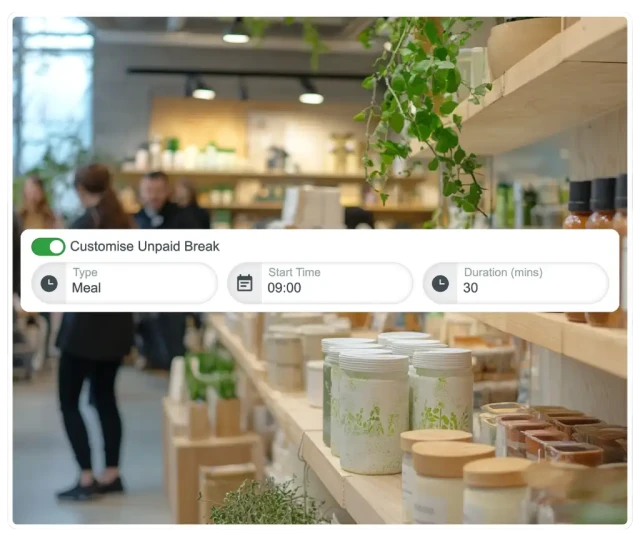

Enjoy the simplicity of a user-friendly interface that makes creating and managing rosters a breeze.

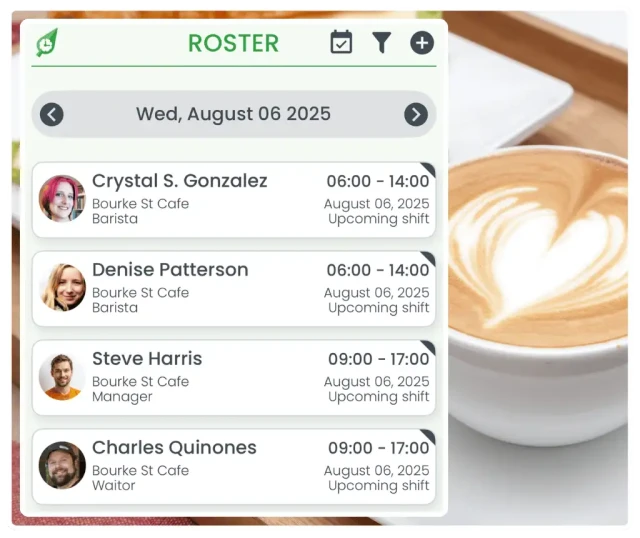

Learn moreManage your rosters on-the-go with intuitive mobile apps for both iOS and Android devices.

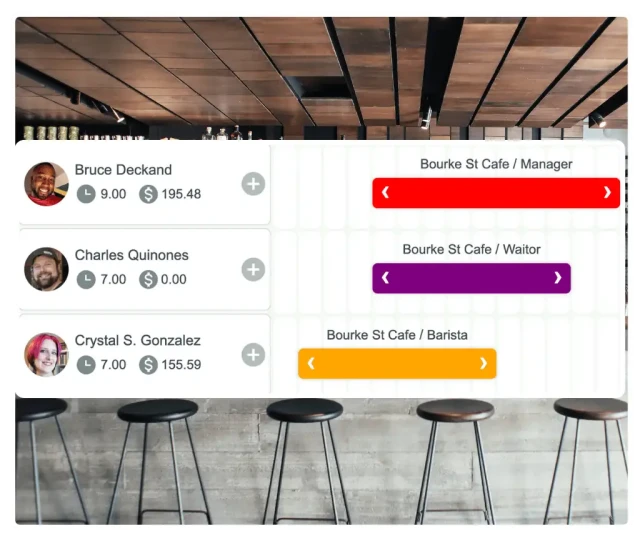

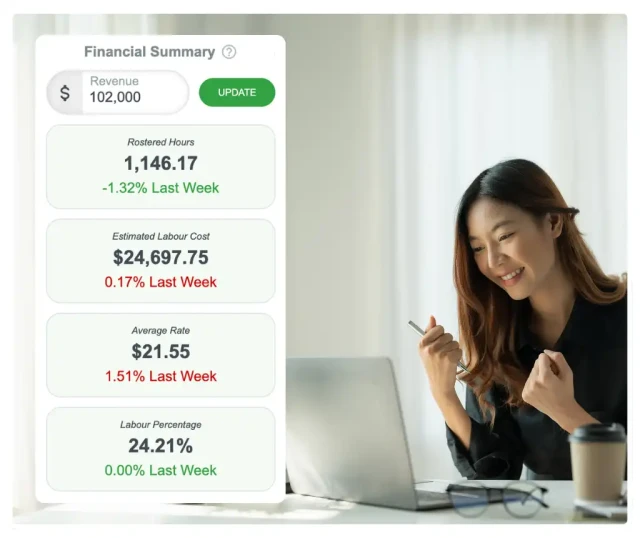

Learn moreTrack labour costs and budgets in real-time to ensure cost-effective staffing solutions.

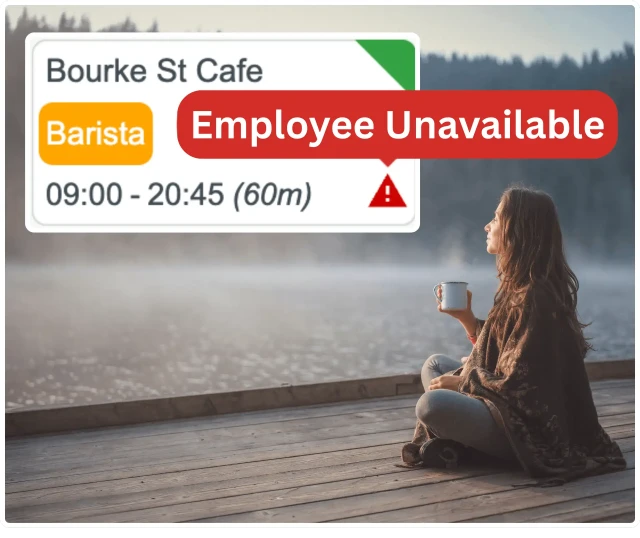

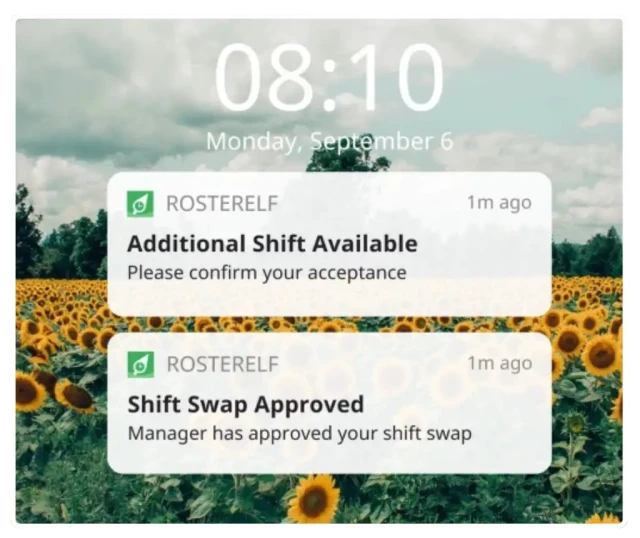

Learn moreEnhance team communication with instant notifications and updates for all roster changes.

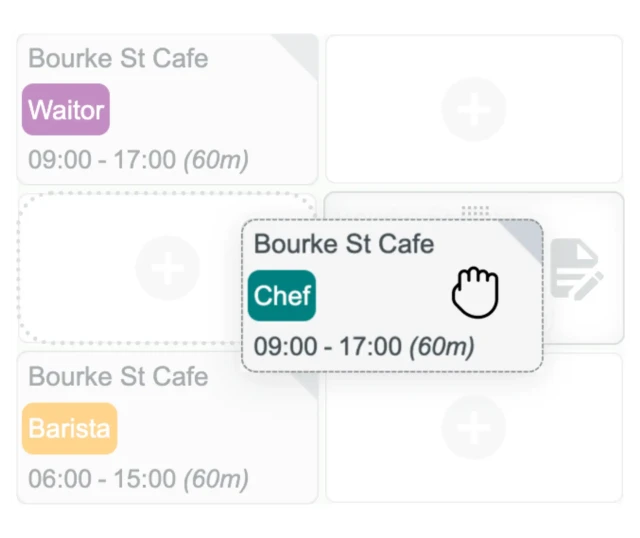

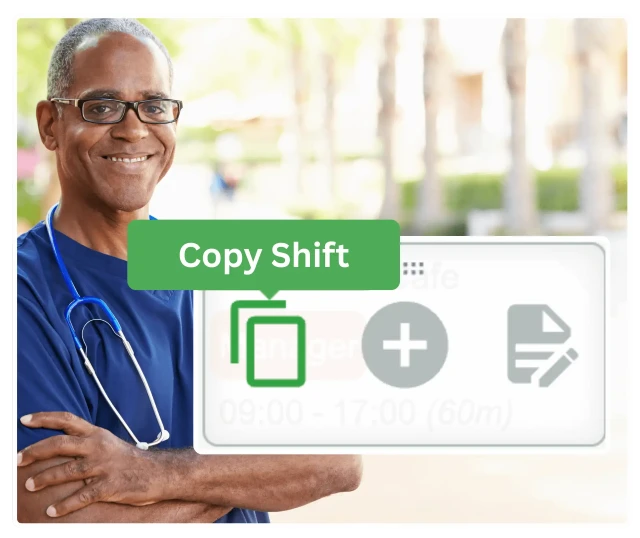

Handle shift swaps effortlessly with features that ensure adequate coverage and flexibility.

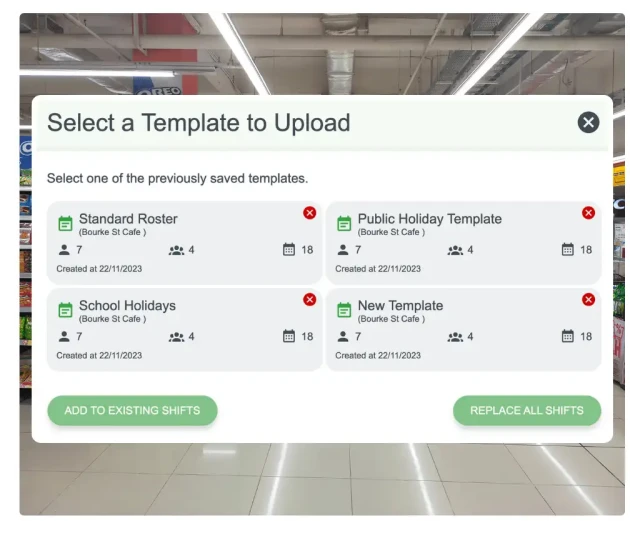

Learn moreStreamline your scheduling process by using and copying templates for quick and consistent roster creation.

Learn more

At RosterElf, we're passionate about our customers. Our team of rostering experts is dedicated to providing unlimited support, whether you're setting up or using our software long-term.

Rostering and payroll software questions? We have the answers