Why Australians are turning to side hustles

Across Australia, thousands of workers are supplementing their income with side hustles. Rising living costs and flexible digital platforms make it easier than ever to earn extra money beyond a main job. According to the Australian Bureau of Statistics, participation in casual and gig work has increased steadily, particularly among younger Australians and those in hospitality and retail.

Side hustles range from rideshare driving to freelancing. While they provide welcome flexibility, they also create challenges for employees and employers when it comes to fatigue, compliance, and work-life balance.

Most popular side hustles in Australia

Here are some of the most common side hustles Australians choose to boost their income:

- Rideshare driving: Uber and DiDi offer flexible hours, though vehicle costs and reporting obligations apply.

- Food and parcel delivery: Services like Uber Eats and Menulog are popular among students and casual staff.

- Freelancing: Writing, graphic design, digital marketing, and IT support via platforms like Upwork or Fiverr.

- Tutoring: Online or in-person tutoring remains in demand, especially for maths, English, and STEM subjects.

- Hospitality shifts: Picking up extra casual shifts through agencies or apps.

Each comes with different time, tax, and compliance considerations. Employers benefit when staff balance commitments responsibly and transparently.

Legal and tax considerations for side hustles

Running a side hustle in Australia comes with responsibilities. The Australian Taxation Office requires individuals to declare all income, even from gig work. Depending on the scale, an ABN registration or GST obligations may apply.

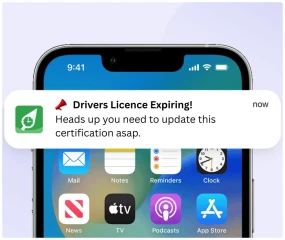

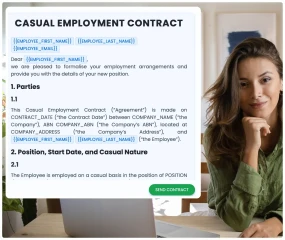

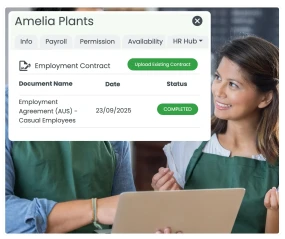

From an employment law perspective, employers must ensure staff rosters respect maximum hours and rest breaks under the National Employment Standards and relevant Modern Awards. Employees who overcommit risk breaching fatigue and compliance safeguards. Employers can use Rostering tools to map availability accurately and Award Interpretation to catch penalty triggers early.

Balancing primary work and side hustles

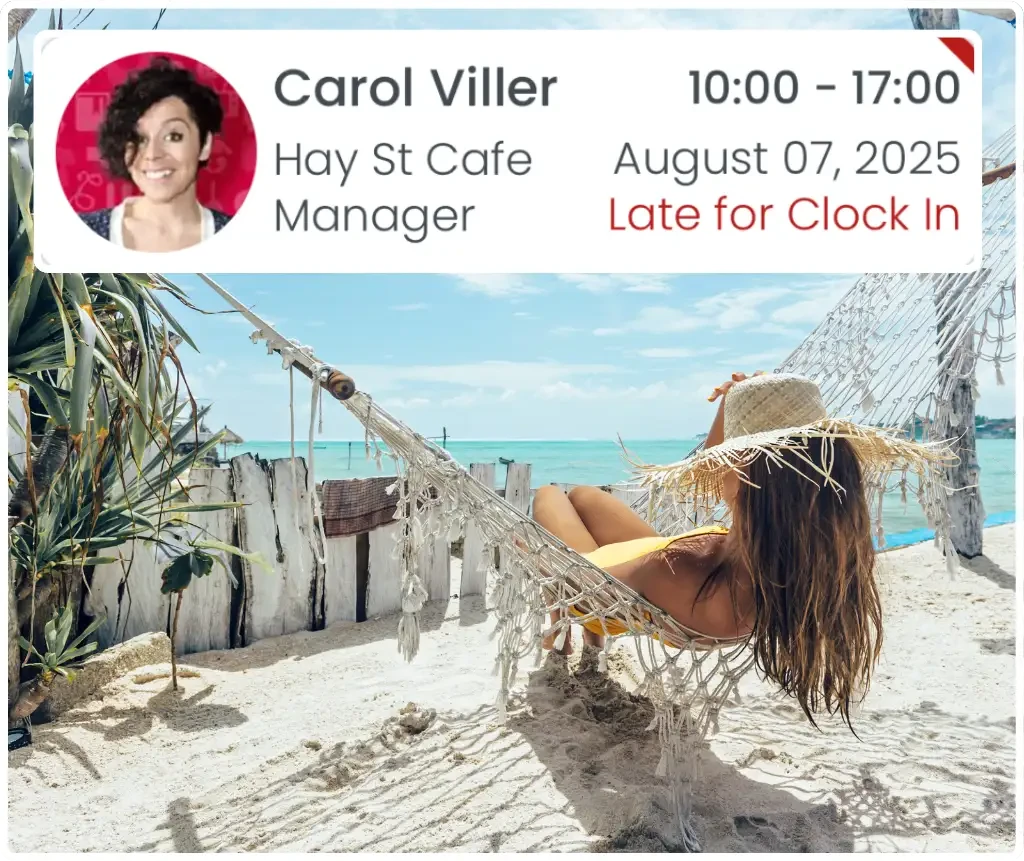

One of the biggest risks of side hustles is conflict with main employment. Staff stretched across multiple commitments may be unavailable during peak shifts or may turn up fatigued. Employers must balance business needs with flexibility to retain talent.

- Track total hours across jobs to avoid exceeding safe limits.

- Communicate availability honestly with managers.

- Use tools like Time & Attendance to capture real attendance data and adjust rosters proactively.

Employers who embrace flexibility often enjoy better retention. When staff can pursue side hustles without clashing with primary work, satisfaction improves.

Case study: Side hustle success story

Consider Alex, a café worker in Melbourne. With rising costs, Alex began tutoring students on weekends. Initially, late‑night shifts followed by early tutoring left him fatigued. After his employer adopted RosterElf’s Rostering and Time & Attendance, managers aligned shifts with Alex’s tutoring commitments. Fatigue dropped, performance improved, and Alex retained both jobs sustainably.

This example shows how digital rostering can support staff pursuing side hustles while keeping compliance and service levels intact.

How RosterElf supports the side hustle generation

RosterElf’s features are designed for flexibility and compliance. Benefits include:

- Smart rostering: publish schedules aligned with staff commitments.

- Live attendance: confirm attendance in real time to address gaps quickly.

- Award interpretation: apply Fair Work rules correctly to reduce compliance risks.

- Leave and availability planning: plan for absences and prevent last‑minute changes.

These tools give employers confidence that side hustles won’t compromise compliance or customer service.

Action plan: Making side hustles sustainable

To ensure side hustles add income without harming wellbeing:

- Audit hours: employees track all hours worked across roles.

- Check compliance: employers validate rosters against NES and award requirements using Award Interpretation.

- Set policies: publish clear expectations about secondary work and communication of availability.

- Leverage technology: integrate Rostering and Time & Attendance to catch issues before they escalate.

By combining transparent policies with digital tools, businesses can support staff who pursue side hustles while protecting compliance and productivity.