What are 'Employment Awards' in Australia?

In Australia, employers are required to pay their employees in accordance with the terms of the applicable 'employment award', also known as a 'modern award'.

An employment award in Australia is a legally binding document that sets out the minimum pay and conditions for employees in a specific industry or occupation. These awards and award rates are created and reviewed by the Fair Work Commission (FWC), an independent government body that oversees Australia's national workplace relations system. This employment award system was introduced as part of the Fair Work Act 2009, which aimed to simplify and modernise the award system in Australia. The modern award system replaces the previous one, with thousands of award rates covering different industries and occupations.

Modern awards cover various industries and occupations, such as retail, hospitality, construction, healthcare, and many more. They include information on minimum wages, overtime rates, leave entitlements, and other pay and conditions that apply to employees in the specific industry or occupation. Modern awards also include provisions for flexible working arrangements, dispute resolution, and training and development.

Employers are legally required to comply with the modern award rates that apply to their employees. It's important for employers to identify the correct award rate for their employees and ensure they are paying them according to the terms of the award.

Where can I find the right employment award for my business?

The best place to find a list of current Australian employment awards and award rates is on the Fair Work Commission website (www.fwc.gov.au) and then going to the "Awards" page. The awards are organised by industry or occupation, so business owners must search for the specific award that applies to their employees. The Fair Work Commission is responsible for setting and reviewing the minimum wages and conditions for employees in the national workplace relations system, which covers most private sector employees in Australia.

Alternatively, you can also use the Fair Work Ombudsman website to find the list of awards that applies to your business.

It's important to note that some state and territory governments have their own awards and industrial agreements that apply to certain industries or regions. You might want to check with your state government's workplace relations agency for further information on awards that might apply to your business.

What are the normal conditions in employment awards?

Australian employment awards can include a range of rules, but some of the most common you will find are:

-

Minimum wages: This sets the lowest amount that an employee can be paid for their work.

-

Overtime rates: This sets the rate at which employees must be paid for any hours worked over their regular hours.

-

Leave entitlements: This includes annual leave, personal leave (sick leave), and carer's leave.

-

Shift work and penalty rates: This sets the pay rates for employees who work certain shifts or on weekends or public holidays.

-

Allowances: This includes additional pay for things like working in hazardous or remote locations, or for specific types of work such as working with children.

-

Superannuation: This is the amount that the employer must contribute to the employee's retirement savings.

-

Redundancy pay: This sets the amount of pay an employee is entitled to receive if they are made redundant.

-

Training and development: This includes provisions for employers to provide training and professional development opportunities to their employees.

-

Dispute resolution: This includes procedures for resolving disputes between employees and employers.

-

Flexible working arrangements: This includes provisions for employees to request flexible working arrangements such as part-time, job-sharing, and working from home.

What are the penalties for businesses that do not comply with Australian Employment Awards?

Underpaying employees in Australia is a serious violation of the Fair Work Act 2009, and businesses can face significant penalties if they are found to be underpaying their employees. Penalties for underpayment can include fines, back payment of wages, and other legal penalties. The Fair Work Ombudsman (FWO) is responsible for enforcing compliance with the Fair Work Act and can investigate complaints of underpayment. If the FWO finds that a business has underpaid its employees, it may take legal action against it.

Penalties for underpaying employees can include:

-

Monetary penalties: Businesses can be ordered to pay fines of up to $63,000 per contravention for underpaying employees.

-

Back payment of wages: Businesses may be ordered to pay back any unpaid wages or entitlements to their employees.

-

Court-ordered penalties: Businesses can be ordered to pay additional penalties by the court, including fines and/or imprisonment for the directors or other individuals involved in the underpayment.

-

Public notification: Businesses that are found to have underpaid their employees may be required to publicly notify the FWO of their contraventions and provide evidence of rectification.

-

Compliance notices: The FWO can issue a compliance notice to the business, requiring them to take certain actions to rectify non-compliance issues.

-

Prosecution: In serious cases, the FWO may initiate legal proceedings against the business, which can result in fines, penalties and in some cases, imprisonment.

What can business owners do to ensure employment award compliance?

While the modern award system is intended to simplify and modernize the system of different award rates, it can be complex for business owners to navigate and understand it and all the different award rates. It's important for employers to be aware of their obligations under the Fair Work Act and to ensure that they are paying their employees correctly to avoid penalties.

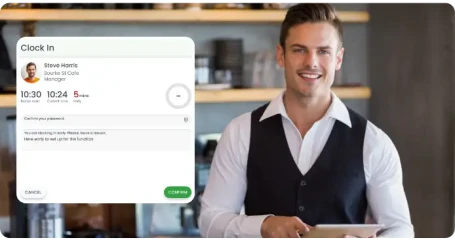

With the massive complexity of Australian awards and huge penalties for getting it wrong, for many businesses implementing an award interpretation software solution like RosterElf to automate payroll compliance may be one of the best ideas.

RosterElf helps employers understand and comply with the specific pay and conditions outlined in the award that applies to their employees. We support employers in navigating the complex and ever-changing laws and regulations surrounding award interpretation and ensuring that they are paying their employees correctly and in compliance with the award.

These types of software solutions typically include features such as:

-

Award interpretation: RosterElf helps employers understand the specific pay and conditions outlined in the award that applies to their employees. Including different award rates like minimum wages, overtime rates, leave entitlements, and other pay and conditions.

-

Payroll calculations: RosterElf automatically calculates the correct pay and entitlements for employees based on the award and the employee's hours worked, overtime, leave taken, etc.

-

Reports and compliance: We generate reports that help employers to ensure compliance with the award and provide evidence that they are paying their employees correctly.

-

Cloud-based: Some of the software solutions are cloud-based, and they can be accessed from anywhere at any time, making it easy for employers to manage payroll and compliance from anywhere.

-

Other Features: Many include a range of complementary features such as rostering, time and attendance, onboarding and leave management.

If you want help implementing an award interpretation tool in your business, book a demo with our team.

Book a demo call with our team

Learn about more success stories or see all our blog articles and business news.