Disclaimer:

This guide provides general information only and should not be relied upon as professional advice. Payroll and accounting requirements can vary depending on your business circumstances. Always check with your accountant or contact Xero directly to confirm the best approach for your situation.

This article explains how to set a staff member's superannuation in Xero. Adding superannuation directly to the employee's pay template ensures it is included automatically in every pay run. This saves time, reduces manual errors, and helps you support your compliance efforts with superannuation obligations.

Once superannuation is set, you no longer need to adjust it each pay run. Xero applies it to the employee's wages every time, creating consistency and accuracy in payroll. Following this guide will help you manage superannuation contributions correctly, so your staff are paid the right entitlements and your records stay accurate for reporting.

1. Add superannuation in Xero pay template

This section explains how to add superannuation directly into an employee's pay template in Xero. By doing this, superannuation will apply automatically when generating pay runs. This removes the need for manual updates and supports compliance with superannuation obligations.

1.1 open employee pay template in Xero

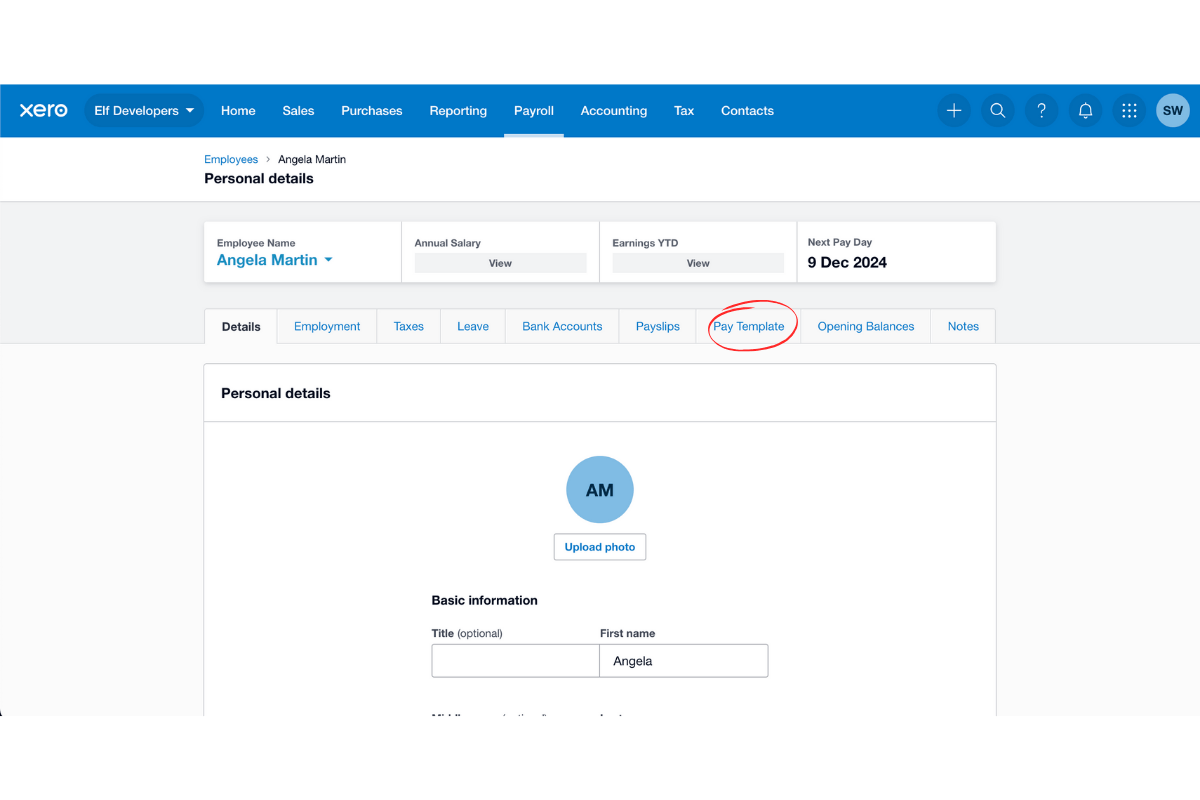

1.1.1 Log in to Xero.

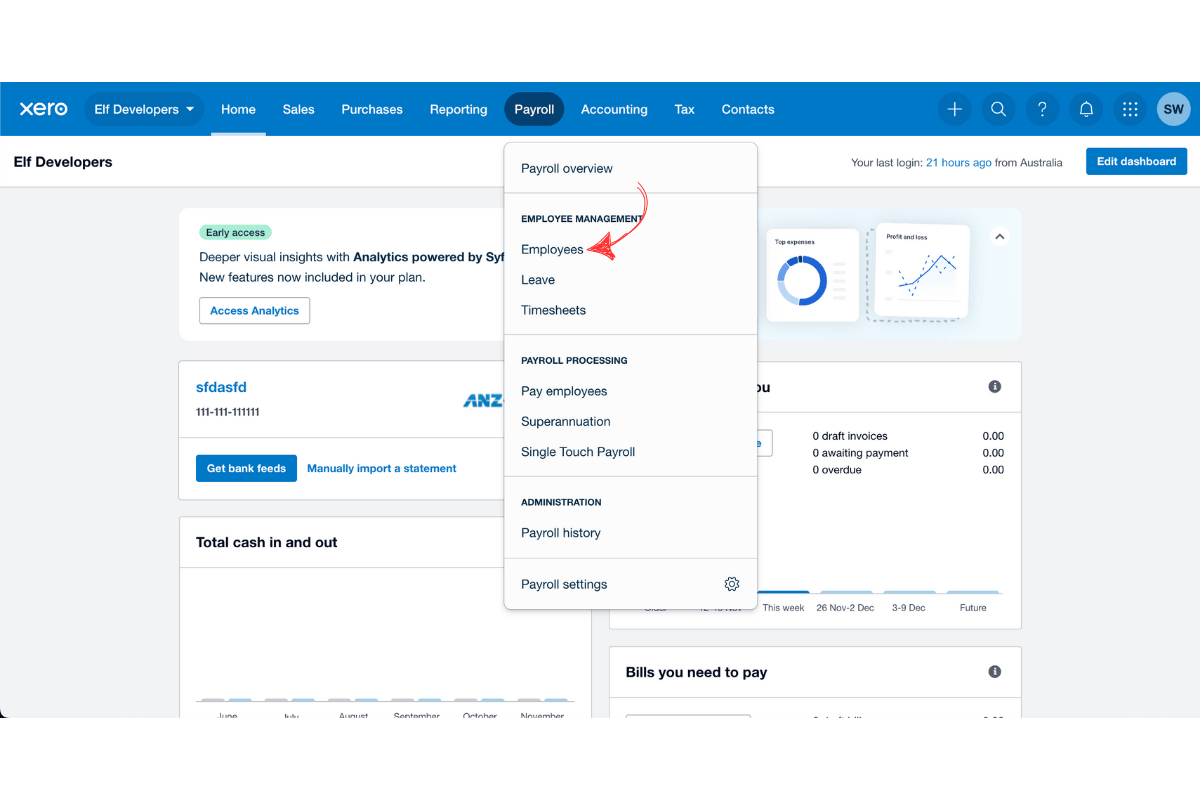

1.1.2 Press Payroll > Employees.

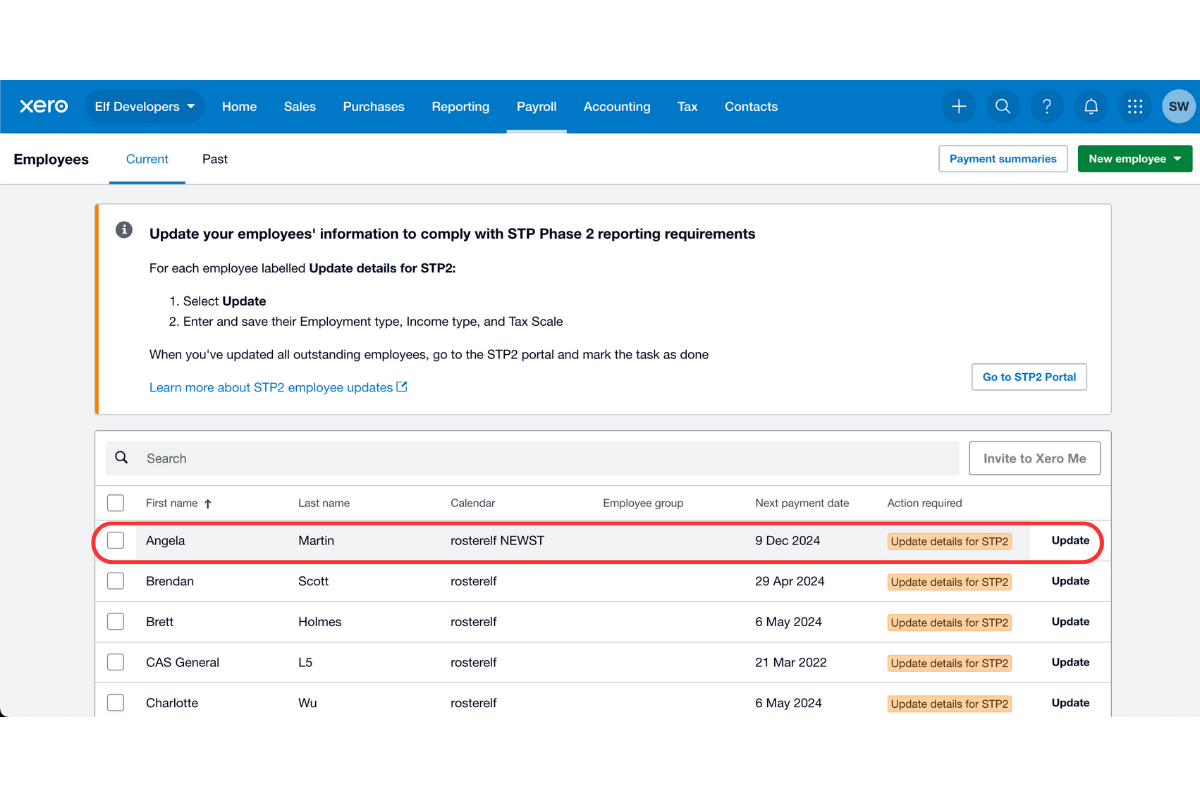

1.1.3 Click on the employee you want to update.

1.1.4 Select Pay Template.

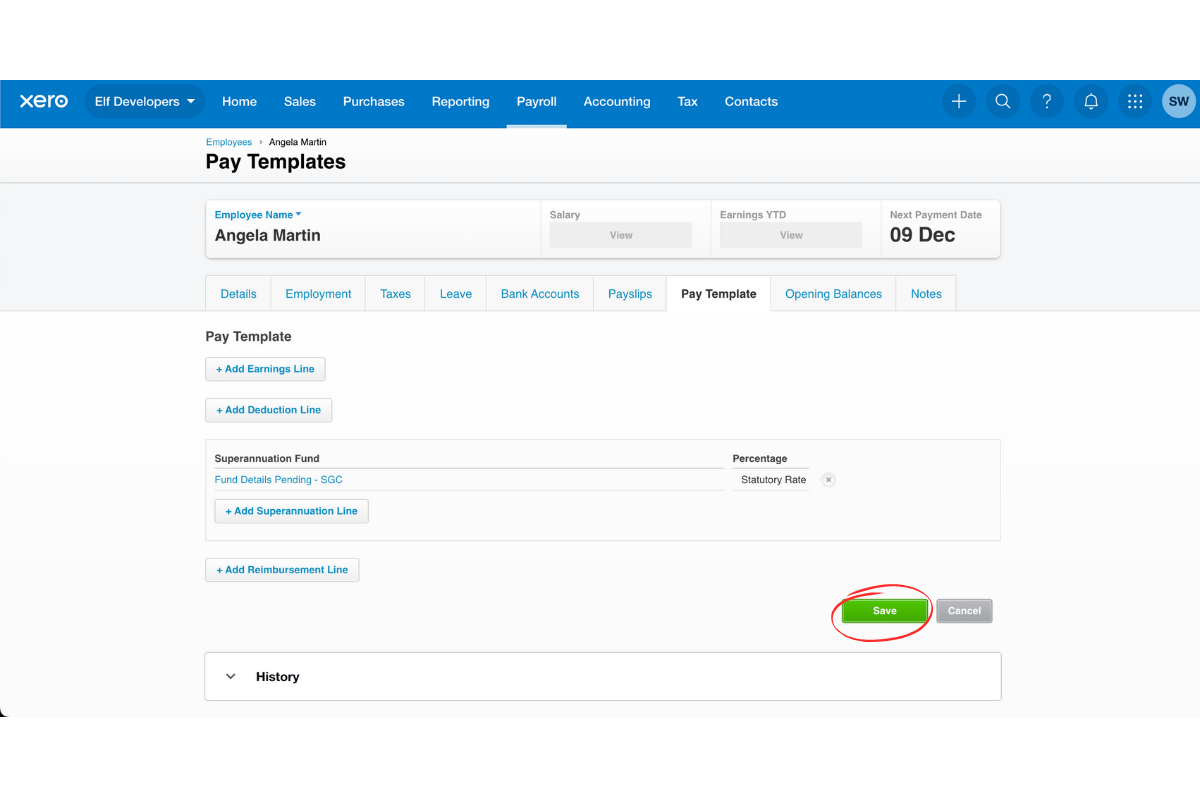

1.2 add and save superannuation

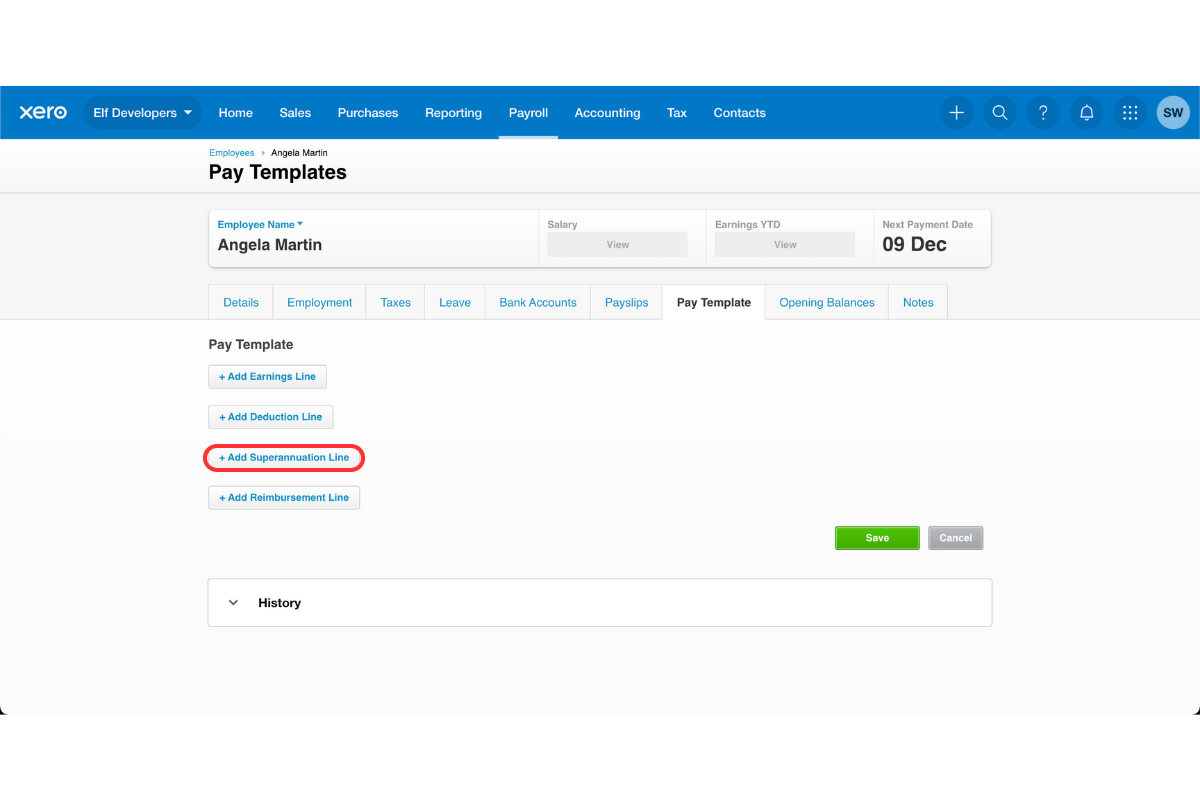

1.2.1 Click Add superannuation line.

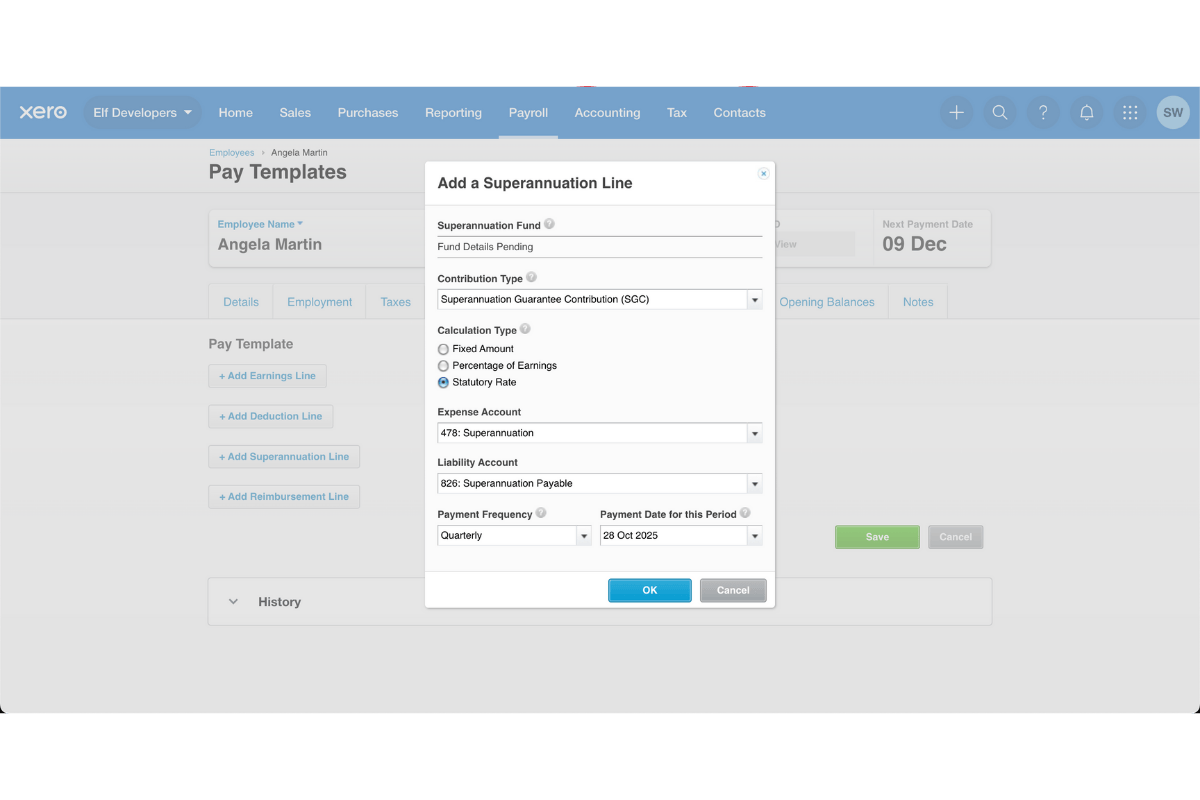

1.2.2 Enter the superannuation details.

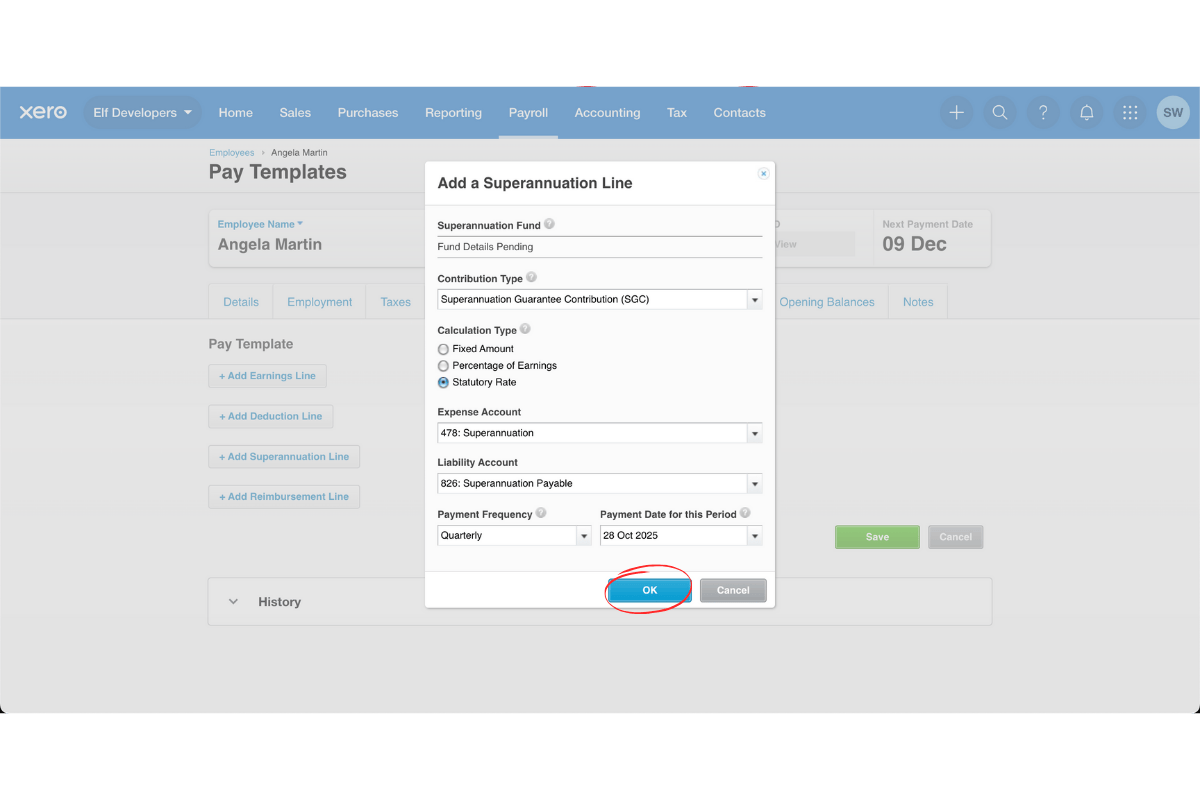

1.2.3 Press Ok.

1.2.4 Press Save.