Introduction to country-specific tax settings

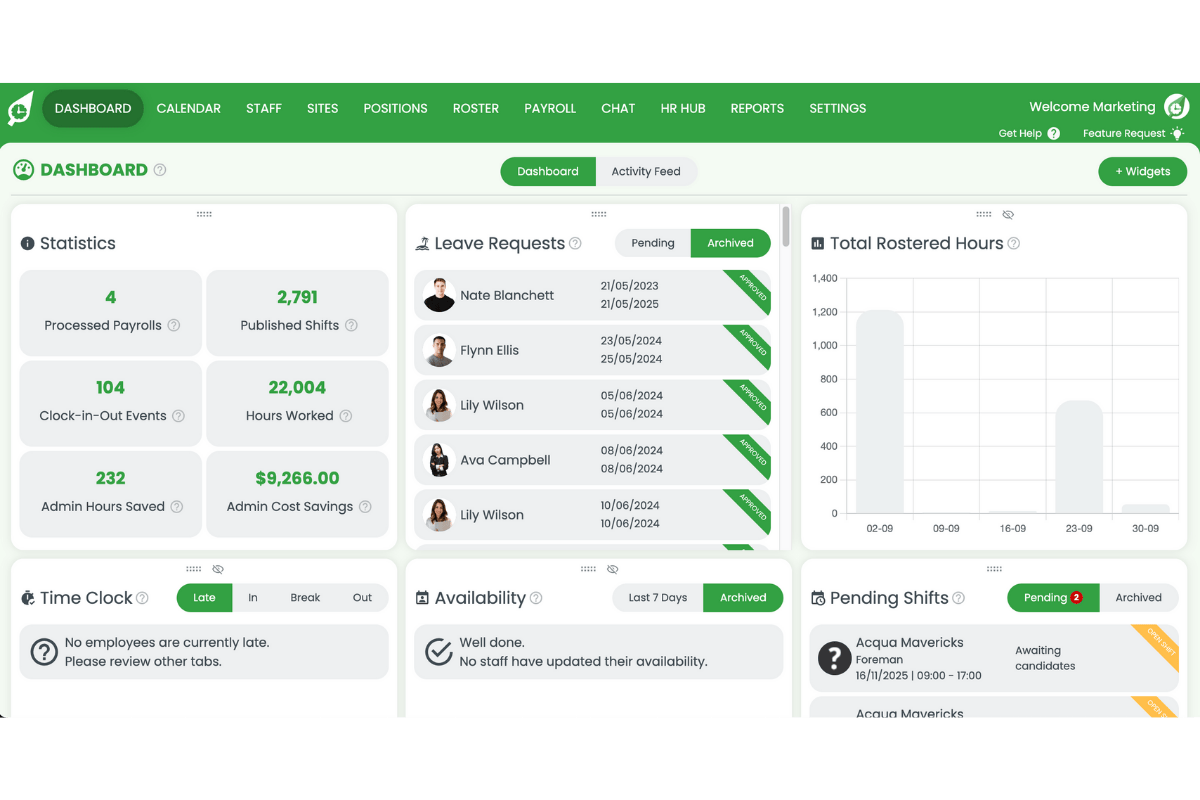

This article explains how to set your country specific tax settings in RosterElf. Configuring the correct tax settings ensures your account reflects the payroll and compliance rules of your location. With the right setup, your pay runs will follow the correct tax laws, reducing the risk of errors and keeping your business compliant.

1. Open account information in RosterElf

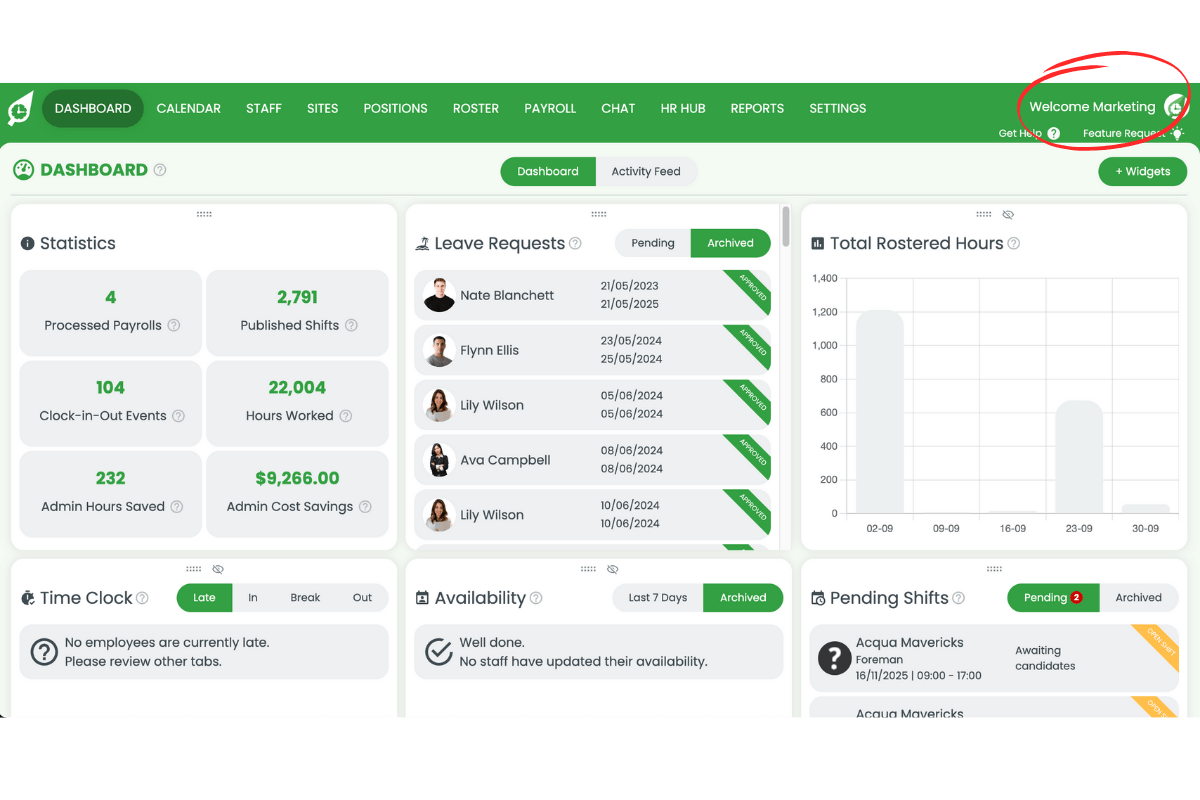

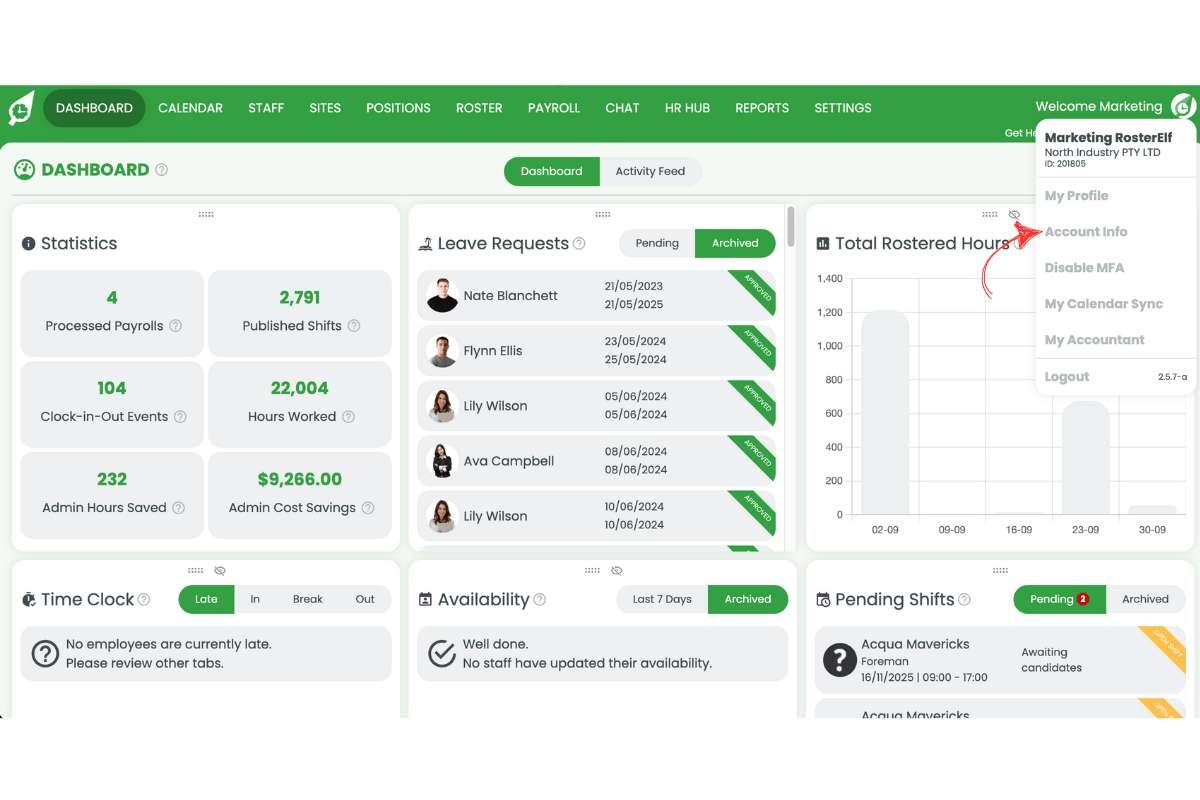

You need to access your account information before you can update your country specific tax settings.

1.1 access account information

1.1.1 Log in to RosterElf.

1.1.2 Press the welcome message at the top of the page.

1.1.3 Select Account info from the menu.

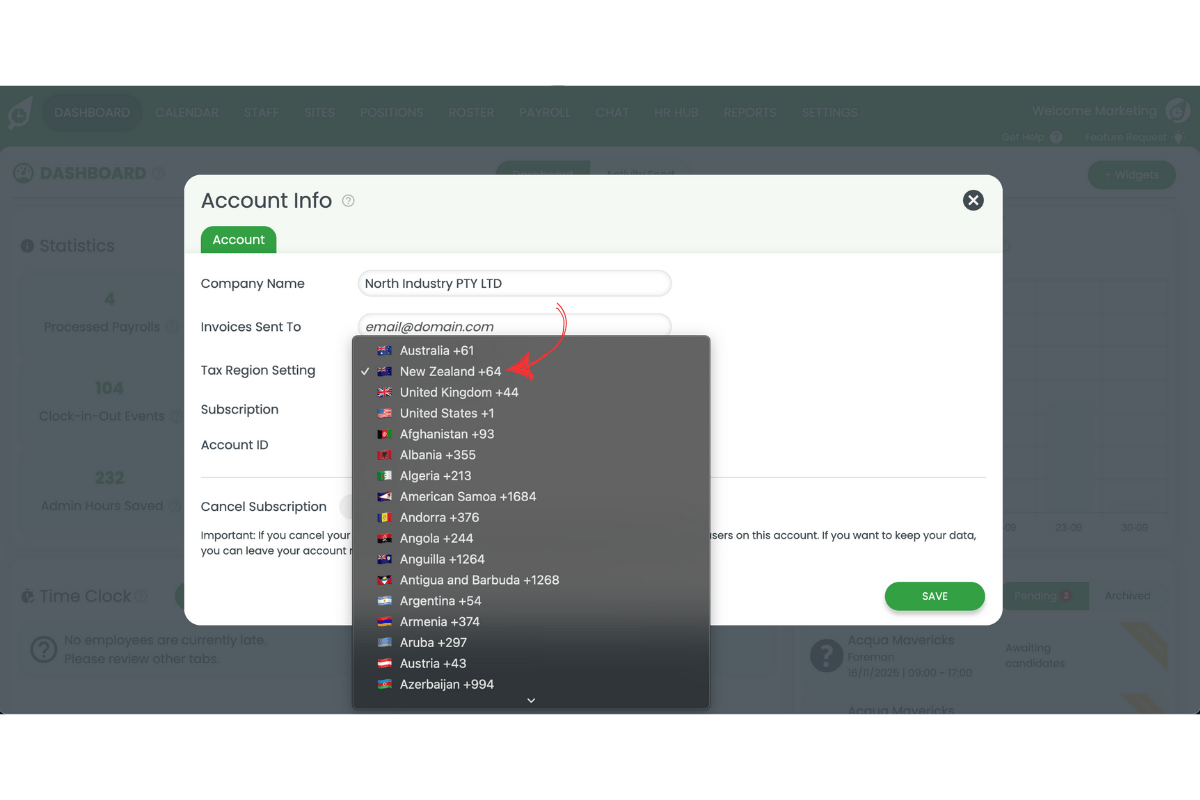

2. Update country specific tax settings

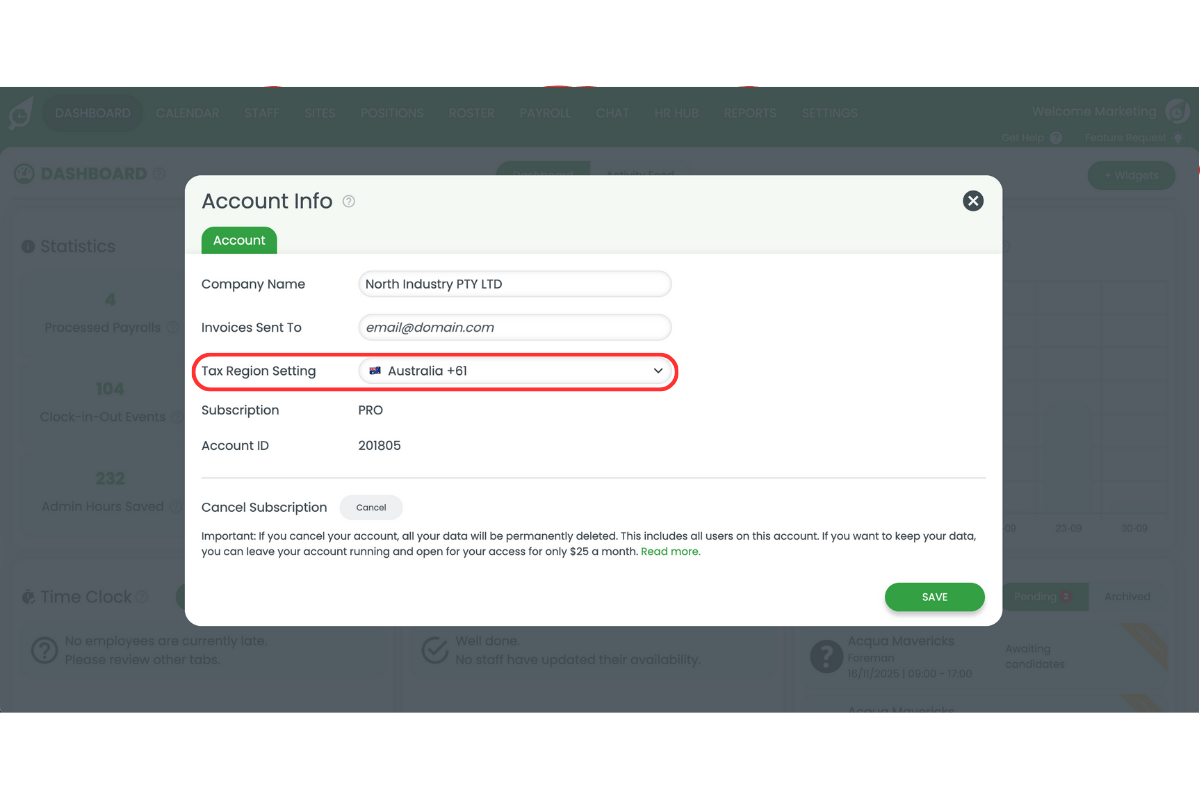

Once you open your account information, you can adjust your country specific tax settings. Updating these details ensures your payroll runs in line with your local tax laws.

2.1 change tax settings

2.1.1 Locate the tax settings section.

2.1.2 Adjust the settings for your country as required.

2.1.3 Press Save to confirm your changes.

Note:

Saving changes applies the new settings immediately to future payroll runs. This helps ensure your staff payments remain accurate and your reporting meets local standards.