When payroll goes wrong, the first place to look is almost always the timesheet. Inaccurate time records are the root cause of most payroll errors, underpayments, and employee disputes in Australian businesses. The good news is that proper payroll integration with time tracking systems can eliminate most of these problems before they reach your payroll run.

For businesses covered by Australian awards, the stakes are particularly high. Complex rate structures with penalty rates, overtime calculations, and allowances mean even small timesheet errors can result in significant underpayments or overpayments over time. Proper award interpretation is essential. When Fair Work investigates, they look at your records—and errors in those records put you at risk.

This guide examines how timesheet problems cause payroll errors, the most common mistakes Australian businesses make, and how to build systems that get payroll right the first time.

Quick summary

- Most payroll errors originate from inaccurate or incomplete timesheet data

- Manual data transfer between systems is a major source of errors

- Integrated time tracking and payroll systems eliminate manual transfer risks

- Automated award interpretation reduces rate calculation errors

For a comprehensive checklist, download our free guide: Payroll Compliance in Australia.

The timesheet-payroll connection

Payroll is only as accurate as the data that feeds it. Timesheets provide the foundation—hours worked, when those hours occurred, and what breaks were taken. From this data, payroll systems calculate wages, apply penalty rates, and determine superannuation contributions.

When timesheet data is wrong, everything downstream is wrong. A small error in recording hours becomes an underpayment. A missed penalty rate becomes a compliance issue. A manual transcription mistake becomes a dispute. The further an error travels through the system before being caught, the more expensive it becomes to fix.

Understanding this connection is the first step to preventing payroll errors. The solution isn't just better payroll software—it's ensuring accurate data reaches payroll in the first place through reliable time and attendance tracking.

Common timesheet mistakes that cause payroll errors

These are the timesheet problems we see most frequently causing payroll issues:

Manual data entry errors

Typing hours from paper timesheets or manually entering clock times introduces typos—8.5 hours becomes 85, or start times are transposed.

Incorrect penalty rate application

Applying the wrong penalty rate or missing penalties altogether—especially for evening, weekend, and public holiday work.

Missing overtime

Not tracking when ordinary hours are exceeded, resulting in overtime being paid at ordinary rates instead of time-and-a-half or double time.

Break calculation errors

Deducting breaks that weren't taken or not deducting breaks that were—both create payroll inaccuracies.

Copy-paste errors

When transferring data between spreadsheets or systems, rows get duplicated, deleted, or shifted—affecting multiple employees.

Wrong employee classification

Applying the wrong award level or classification results in incorrect base rates, which affect all subsequent calculations.

The true cost of payroll errors

Payroll errors cost more than just the incorrect payment amount. The full impact includes:

- Back-pay liability: Underpayments can accumulate over years. A $50 per fortnight error over three years becomes $3,900 per affected employee—plus interest.

- Administrative time: Investigating errors, recalculating pay, processing adjustments, and communicating with employees consumes significant manager time.

- Employee trust: Staff who are underpaid—even accidentally—lose trust in their employer. This affects engagement, retention, and workplace culture.

- Compliance risk: Systematic errors can trigger Fair Work investigations, with penalties reaching tens of thousands of dollars per contravention.

- Reputation damage: Wage theft allegations—even when errors are genuine mistakes—can damage your reputation with customers and future employees.

How integration prevents payroll errors

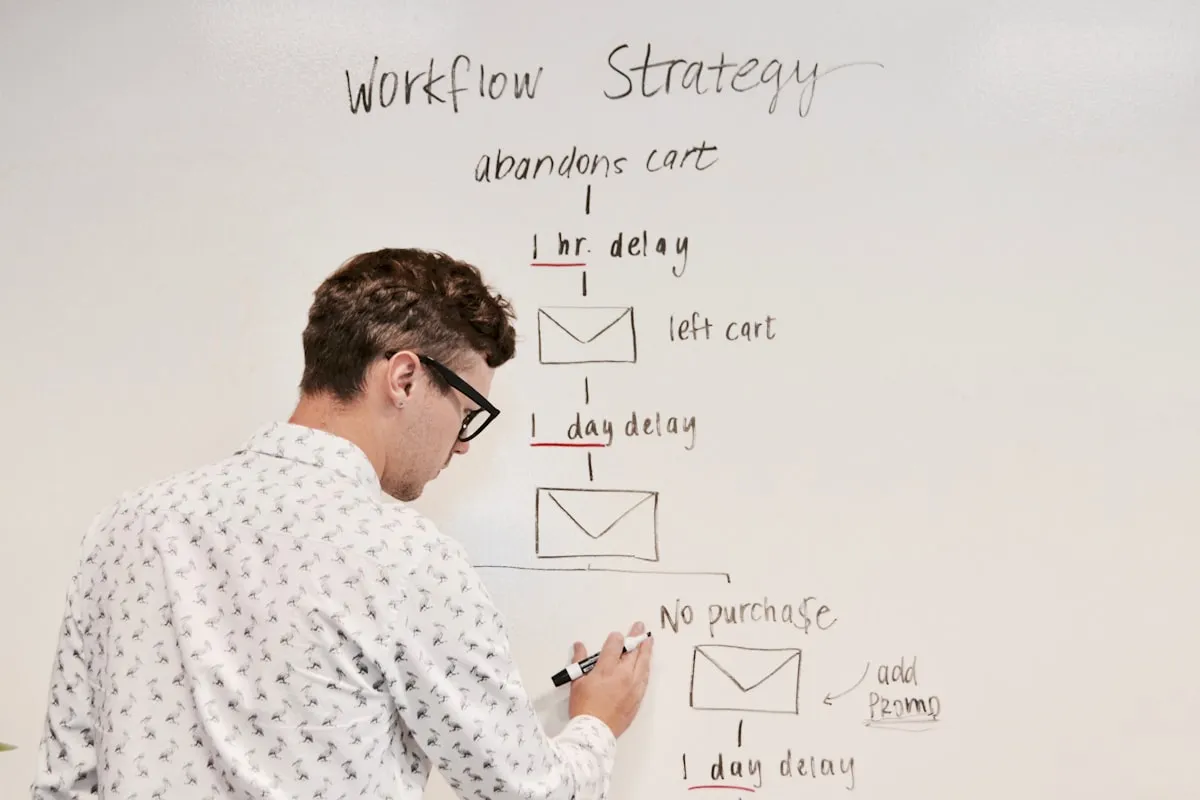

The most effective way to prevent timesheet-related payroll errors is to eliminate the gaps where errors occur. Integration between time tracking and payroll systems does this by:

Removing manual data transfer

When time tracking data flows directly to payroll, there's no opportunity for transcription errors. Hours, times, and classifications transfer automatically.

Applying rates at the source

Integrated systems apply award rates and penalties when hours are recorded, not during payroll processing. This catches issues earlier and ensures consistency.

Creating verification checkpoints

Modern systems allow managers to review and approve timesheets before export, creating a verification step that catches errors before they affect pay.

Maintaining audit trails

Integrated systems track every change, from original clock time through to payroll export. If questions arise, you can trace exactly what happened.

Enabling roster vs actual comparison

Integration with rostering systems allows automatic comparison of scheduled vs actual hours, flagging unexpected variances for review.

What to look for in payroll integration

Not all integrations are equal. Here are the features that make integration effective at preventing errors:

Australian payroll compatibility

Native integration with Xero, MYOB, and other Australian payroll systems with correct field mapping.

Award rate automation

Automatic application of correct rates based on time, day, and employee classification before data reaches payroll.

Approval workflows

Manager review and approval steps before export, ensuring timesheets are verified before affecting payroll.

Exception reporting

Automatic flagging of unusual entries—excessive hours, missing breaks, unexpected overtime—for review before export.

Two-way sync capability

Ability to sync employee details between systems so changes in one place are reflected everywhere.

Detailed export reports

Clear reports showing exactly what was exported to payroll, enabling quick verification and troubleshooting.

What to do when payroll errors occur

Even with good systems, errors can slip through. Here's how to handle them:

- If you discover an underpayment: Calculate the correct amount immediately, pay the shortfall in the next available pay run (or sooner for significant amounts), document the error and correction, and communicate transparently with the affected employee.

- If you discover an overpayment: Check your employment contracts and relevant awards for overpayment recovery provisions. Communicate with the employee before making any deductions. Arrange a reasonable repayment plan if needed.

- If an employee raises a pay concern: Investigate promptly and thoroughly. Review timesheets, payslips, and system records. If the employee is correct, acknowledge the error and rectify it. If your records are accurate, explain them clearly.

- If you identify systematic errors: Quantify the full impact across all affected employees and periods. Engage professional advice if the amounts are significant. Develop a remediation plan and implement process improvements to prevent recurrence.

How RosterElf prevents payroll errors

RosterElf connects time tracking directly to payroll systems, eliminating the gaps where errors typically occur:

- Direct payroll export: Approved timesheets export directly to Xero, MYOB, and other Australian payroll systems with correct award rates already applied.

- Award interpretation engine: Rates are calculated automatically based on time of day, day of week, and employee classification—not manually applied during payroll.

- Timesheet approval workflow: Managers review and approve timesheets before export, catching discrepancies before they become payroll errors.

- Roster vs actual comparison: Automatic comparison flags unexpected variances between scheduled and actual hours for investigation.

- Complete audit trail: Every time entry, edit, and approval is recorded, providing clear documentation if questions arise.

- Exception alerts: The system flags unusual patterns—missed breaks, excessive overtime, unusual clock times—for manager attention.

Frequently asked questions

What are the most common causes of payroll errors?

The most common causes include manual timesheet entry errors, incorrect award classification, missing or wrong penalty rates, rounding time entries incorrectly, not tracking breaks properly, and transferring data manually between systems. Proper payroll integration addresses most of these issues.

How do timesheet errors lead to underpayments?

Timesheet errors cause underpayments when hours are recorded incorrectly, overtime isn't tracked, penalty rates aren't applied to the right hours, or breaks are deducted when not actually taken. These small errors compound over pay periods.

Can payroll integration prevent timesheet errors?

Yes. Direct integration between time tracking and payroll systems eliminates manual data transfer, which is a major source of errors. Integrated systems automatically apply correct rates and transfer verified hours directly to payroll.

What should I do if I discover payroll errors?

Calculate the correct amounts immediately, pay any underpayments promptly, document the error and correction, communicate transparently with affected employees, and review your processes to prevent recurrence.

How do award rates affect payroll accuracy?

Australian awards have complex rate structures including base rates, penalty rates for weekends and public holidays, overtime rates, and allowances. Manually calculating these is error-prone. Software with award interpretation improves accuracy significantly.

Is it better to use integrated or standalone payroll software?

Integrated systems that connect time tracking, rostering, and payroll reduce errors by eliminating manual data transfer. Standalone systems require careful manual processes to maintain accuracy between platforms.

How often should timesheets be reviewed before payroll?

Timesheets should be reviewed and approved before every pay run. Many businesses implement daily or shift-end reviews to catch issues early, with a final approval process before payroll export.

Related RosterElf features

Workforce management software built for shift workers

RosterElf gives Australian businesses the tools to manage rosters, track time, and support your compliance efforts—all in one platform designed for shift-based teams.

- Rostering, time tracking, and payroll integration

- Australian award interpretation built in

- Mobile app for staff availability and shift swaps

Disclaimer: This article provides general guidance only and does not constitute legal or financial advice. Payroll requirements and workplace laws change over time. Always verify current requirements using official Fair Work Ombudsman resources before making employment decisions.