Every Australian employer has legal obligations to maintain employee records. Fair Work Australia sets clear requirements about what information must be kept, how long it must be retained, and how it should be accessible. Getting this wrong can result in penalties, complications during disputes, and operational problems when you need information and can't find it.

Modern HR software makes managing employee records far simpler than paper-based systems. Digital HR files are more secure, easier to search, and automatically maintained—but you still need to know what should be in them.

This guide covers the essential records every Australian employer must keep, how long to retain them, and practical steps for building a compliant HR filing system.

Quick summary

- Employee records must include personal details, employment terms, pay records, hours worked, and leave taken

- Most records must be kept for 7 years from the date of the last entry

- Records must be accurate, legible, in English, and readily accessible

- Digital storage is accepted and offers advantages for security and retrieval

Mandatory employee records under fair work

The Fair Work Regulations 2009 specify the records employers must keep. These requirements apply to all employees regardless of whether they're full-time, part-time, or casual.

Employee identification records

- Full name

- Date employment commenced

- Whether employment is permanent, temporary, or casual

- Full-time or part-time status

- Classification level under the applicable award or agreement

Pay and remuneration records

- Pay rate and how it's calculated (hourly, weekly, annually)

- Gross and net pay for each pay period

- Deductions made from each payment

- Allowances, loadings, or penalty rates paid

- Superannuation contributions made on behalf of the employee

Hours of work records

- Number of hours worked each day, or start and finish times

- Any overtime hours worked

- Details of any averaging arrangements for hours

Leave records

- Annual leave accrued and taken

- Personal/carer's leave accrued and taken

- Long service leave (where applicable)

- Parental leave taken

- Any other leave taken or accrued

Other mandatory records

- Tax file number declaration (TFN)

- Superannuation choice form

- Guarantees, agreements, or any individual flexibility arrangements

- Termination records including date and reason for ending employment

Additional recommended records

Beyond the mandatory requirements, maintaining additional records protects your business and supports good HR practice:

- Employment contract: Signed copy of the employment agreement including any variations

- Position description: Current job description and any updates over time

- Emergency contact details: Who to contact in case of workplace emergency

- Qualifications and certifications: Copies of relevant licenses, certificates, and qualifications

- Training records: Documentation of training completed, including workplace safety training. Digital onboarding processes can capture these automatically.

- Performance records: Performance reviews, improvement plans, and related documentation

- Policy acknowledgements: Signed acknowledgements of workplace policies

- Disciplinary records: Warnings, counselling records, and related correspondence

Common HR record-keeping mistakes

These mistakes frequently cause problems for Australian employers:

Incomplete files

Missing key documents like signed contracts, TFN declarations, or super choice forms creates compliance gaps and operational problems. This affects accurate award interpretation.

Destroying records too early

Deleting or disposing of records before the 7-year retention period creates legal exposure, especially if disputes arise later.

Poor organisation

Scattered records across multiple locations, filing systems, or people makes retrieval difficult when you need information urgently.

Inadequate security

Leaving sensitive employee information accessible to unauthorised staff or unsecured creates privacy breaches and legal risk.

Not updating records

Failing to update classification changes, pay increases, or address changes means records don't reflect current employment arrangements.

No backup system

Paper-only systems with no copies or digital systems without backups risk complete loss of records due to damage, theft, or technical failure.

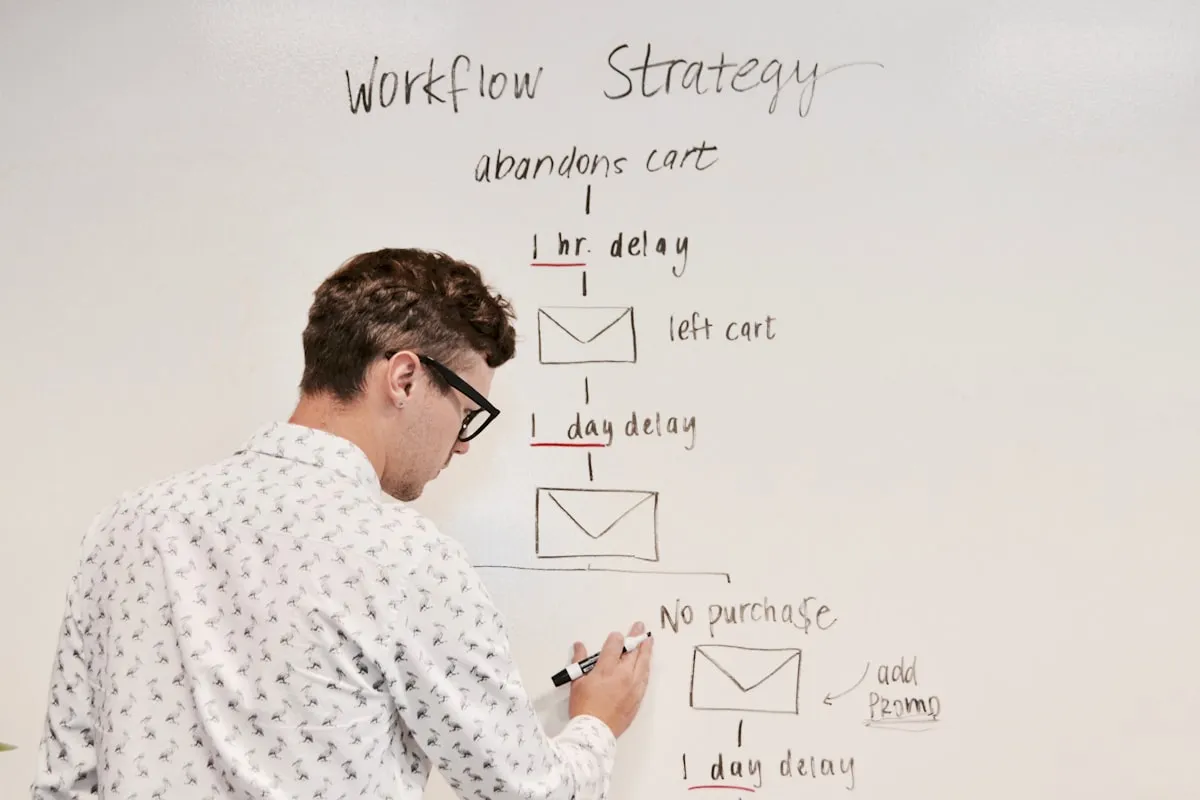

Setting up a compliant HR filing system

Follow this process to establish HR record-keeping that meets Fair Work requirements:

Choose your storage method

Digital systems offer better security, searchability, and backup capabilities. If using paper, ensure secure storage with fire protection and restricted access. Many businesses use a combination approach.

Create a standard file structure

Establish consistent sections for each employee file: personal details, employment terms, pay records, leave records, performance, and training. This makes retrieval efficient and ensures nothing is overlooked.

Implement access controls

Restrict access to employee files to those who genuinely need it—typically HR, direct managers (for their team), and senior leadership. Log who accesses files and when.

Establish onboarding procedures

Create a checklist for new employee documentation that ensures all required records are collected before or during the first week. Link this to your rostering setup process.

Connect to payroll and time tracking

Integrate your HR records with time and attendance and payroll systems so hours worked and pay records update automatically.

Set up retention management

Track when records can be disposed of (7 years from last entry) and implement a review process. Never destroy records prematurely.

Ensure backup and disaster recovery

For digital records, implement automatic backups to secure off-site storage. For paper records, consider scanning critical documents as backup.

What to look for in HR record management software

Digital HR systems offer significant advantages over paper-based filing. Here are the key features to prioritise:

Centralised employee profiles

All employee information in one place, with clear sections for different record types and easy navigation.

Role-based access controls

Granular permissions so different users see only what they need, with audit trails of who accessed what.

Document storage

Ability to upload and store contracts, certificates, acknowledgements, and other documents against employee profiles.

Secure cloud storage

Australian-hosted data centres with encryption, automatic backups, and disaster recovery capabilities.

Integration with time and payroll

Automatic syncing of hours worked and pay records from connected time tracking and payroll systems.

Retention management

Tracking of record retention periods with alerts for upcoming review dates and secure archival processes.

What to do if HR record issues arise

Here's how to handle common HR record problems:

- If you discover missing records: Reconstruct what you can from other sources (payroll records, emails, bank statements). Document your efforts to locate or recreate records. Going forward, implement checks to prevent recurrence.

- If a Fair Work inspector requests records: Provide requested records promptly. If records are incomplete, be transparent about what's missing and why. Demonstrate your commitment to compliance going forward.

- If an employee requests their records: Employees have a right to access their own records. Provide copies within a reasonable timeframe. You may withhold information that relates to other employees or sensitive business matters.

- If you're inheriting poor record-keeping: Conduct an audit to identify gaps. Prioritise collecting current information from existing employees. Document your baseline and improvement efforts.

How RosterElf helps manage employee records

RosterElf's HR hub provides a centralised system for managing employee information alongside rostering and time tracking:

- Centralised employee profiles: All employee details, employment terms, and classifications in one searchable location.

- Document storage: Upload and store contracts, certificates, policies, and other documents against employee records.

- Automatic time and pay records: Hours worked and award rates applied are recorded automatically through time tracking integration.

- Leave tracking: Annual leave, personal leave, and other leave types tracked automatically with full history.

- Secure cloud storage: Data hosted in Australian data centres with encryption and automatic backups.

- Role-based access: Control who can view and edit different types of employee information.

Frequently asked questions

What employee records must australian employers keep?

Australian employers must keep records including employee details, employment contracts, pay records, hours worked, leave taken, superannuation contributions, tax file declarations, and termination details. Records must be accurate, legible, and in English. Learn more about HR record management.

How long must employee records be kept in Australia?

Most employee records must be kept for 7 years. This applies to pay records, timesheets, leave records, and superannuation contributions. Some records like tax documents may have different requirements under ATO rules.

What are the penalties for not keeping proper employee records?

Failure to keep proper employee records can result in penalties under the Fair Work Act. These can be substantial, and in underpayment disputes, inadequate records may shift the burden of proof to the employer.

Can employee records be stored digitally?

Yes. Digital storage is accepted and often preferred as it provides better security, backup capabilities, and easier retrieval. Records must remain accessible and legible throughout the retention period. See our digital HR solutions.

What personal information can employers collect from employees?

Employers can collect information necessary for employment purposes including contact details, tax file numbers, superannuation details, emergency contacts, and qualifications relevant to the role. Privacy principles limit collection to what is reasonably necessary.

Do employers need to keep records for casual employees?

Yes. The same record-keeping requirements apply to casual employees as permanent staff. This includes hours worked, pay rates, leave accrued (if applicable), and all other standard employee records.

What happens to employee records when someone leaves?

Records must be retained for 7 years from the date of the last entry, which typically means 7 years after employment ends. This applies whether the employee resigned, was terminated, or the business was sold.

Related RosterElf features

Workforce management software built for shift workers

RosterElf gives Australian businesses the tools to manage rosters, track time, and support your compliance efforts—all in one platform designed for shift-based teams.

- Rostering, time tracking, and payroll integration

- Australian award interpretation built in

- Mobile app for staff availability and shift swaps

Disclaimer: This article provides general guidance only and does not constitute legal or financial advice. Record-keeping requirements and workplace laws change over time. Always verify current requirements using official Fair Work Ombudsman resources before making employment decisions.