Create pay category in MYOB My business

Disclaimer:

This guide provides general information only and should not be relied upon as professional advice. Payroll and accounting requirements can vary depending on your business circumstances. Always check with your accountant or contact MYOB directly to confirm the best approach for your situation.

This article explains how to create a pay category in MYOB My Business. Pay categories define how different types of earnings are calculated and processed in payroll. Setting up the right category ensures staff are paid correctly, with the right tax and superannuation applied.

By following this guide, you will learn how to create a new pay category, review its settings, and assign it to employees. This process helps you maintain accurate payroll records and ensures compliance with Australian workplace requirements. Clear and accurate pay categories also make it easier to manage allowances, overtime, and other pay variations.

1. Start creating a pay category

To create a pay category, you first need to access payroll settings in MYOB My Business. From here, you can create a new pay item, name it clearly, and adjust the settings to suit your business needs.

1.1 open payroll settings

1.1.1 Log in to MYOB My Business.

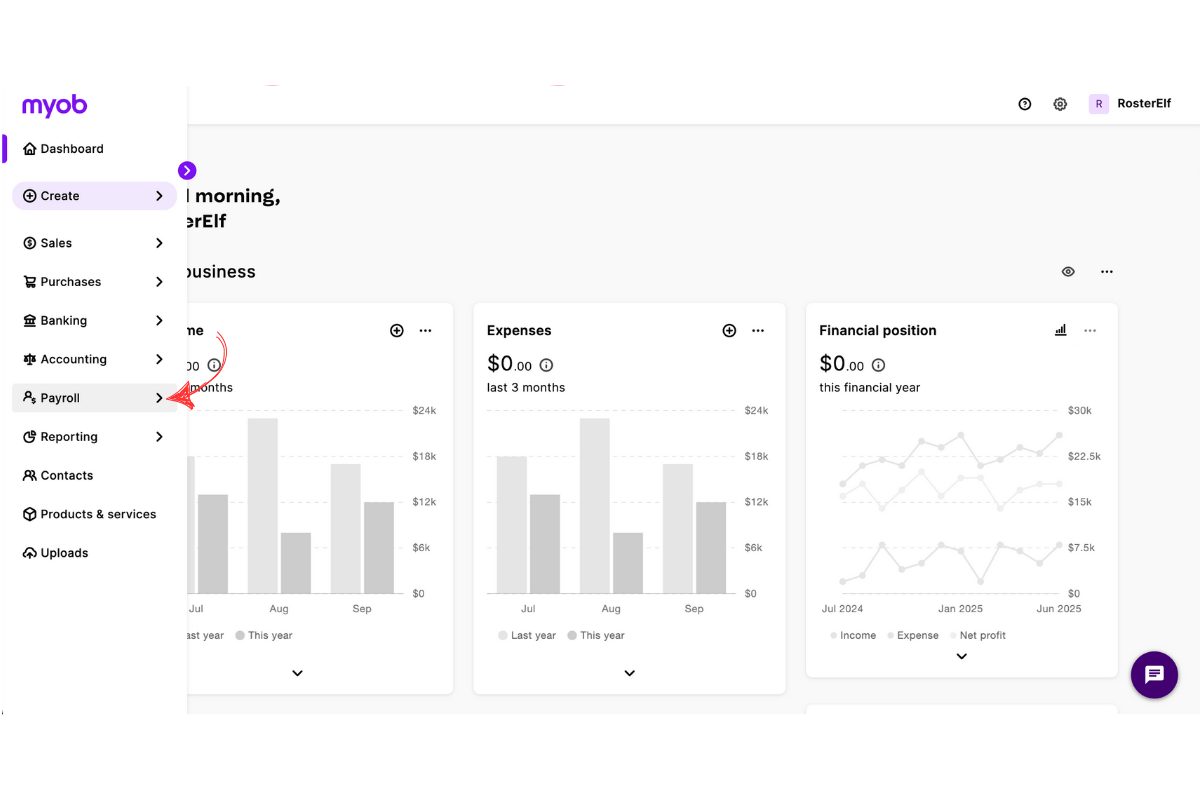

1.1.2 Click Payroll.

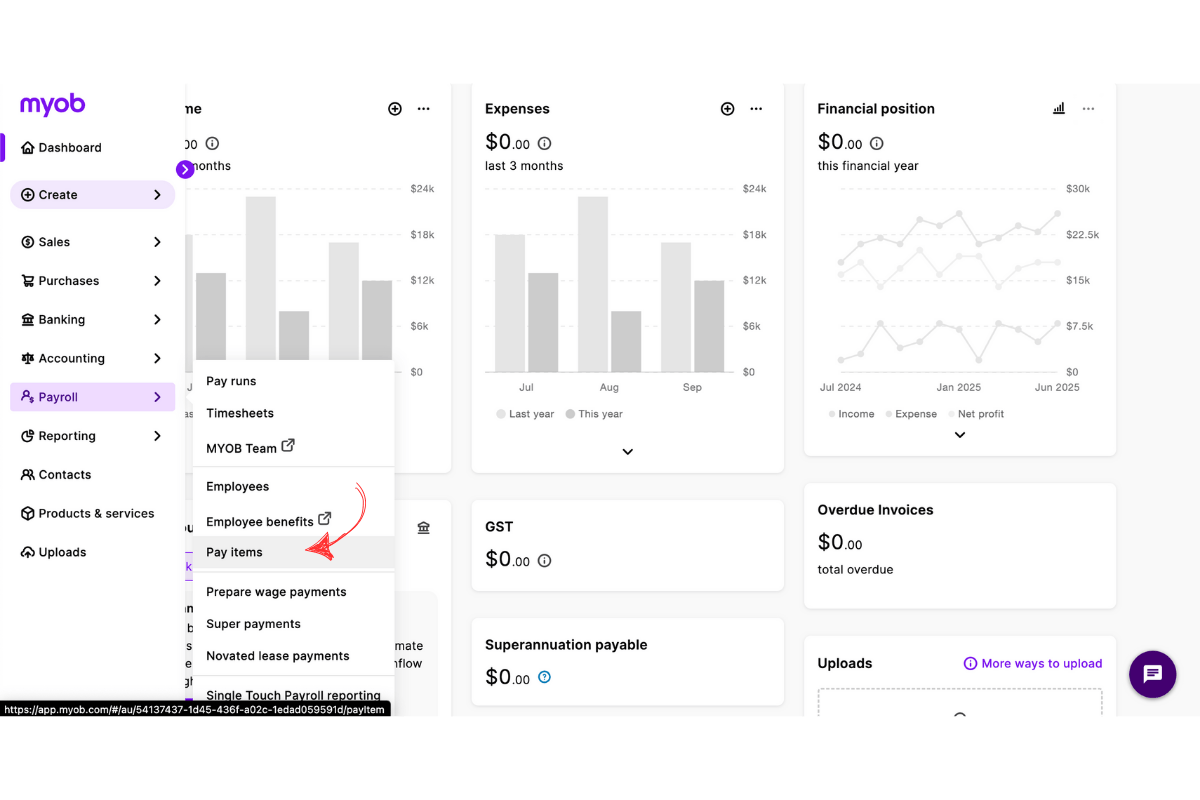

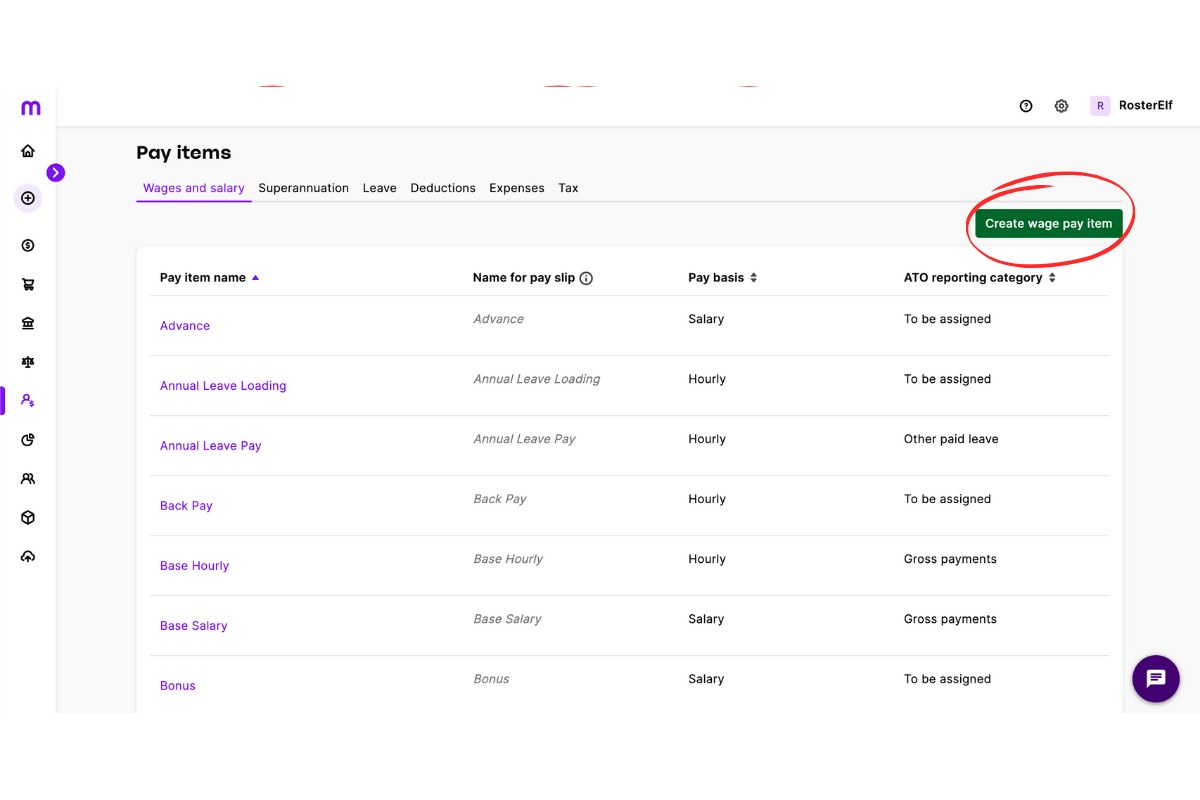

1.1.3 Click Pay items.

1.2 create a new pay item

1.2.1 Press Create Wage Pay Item.

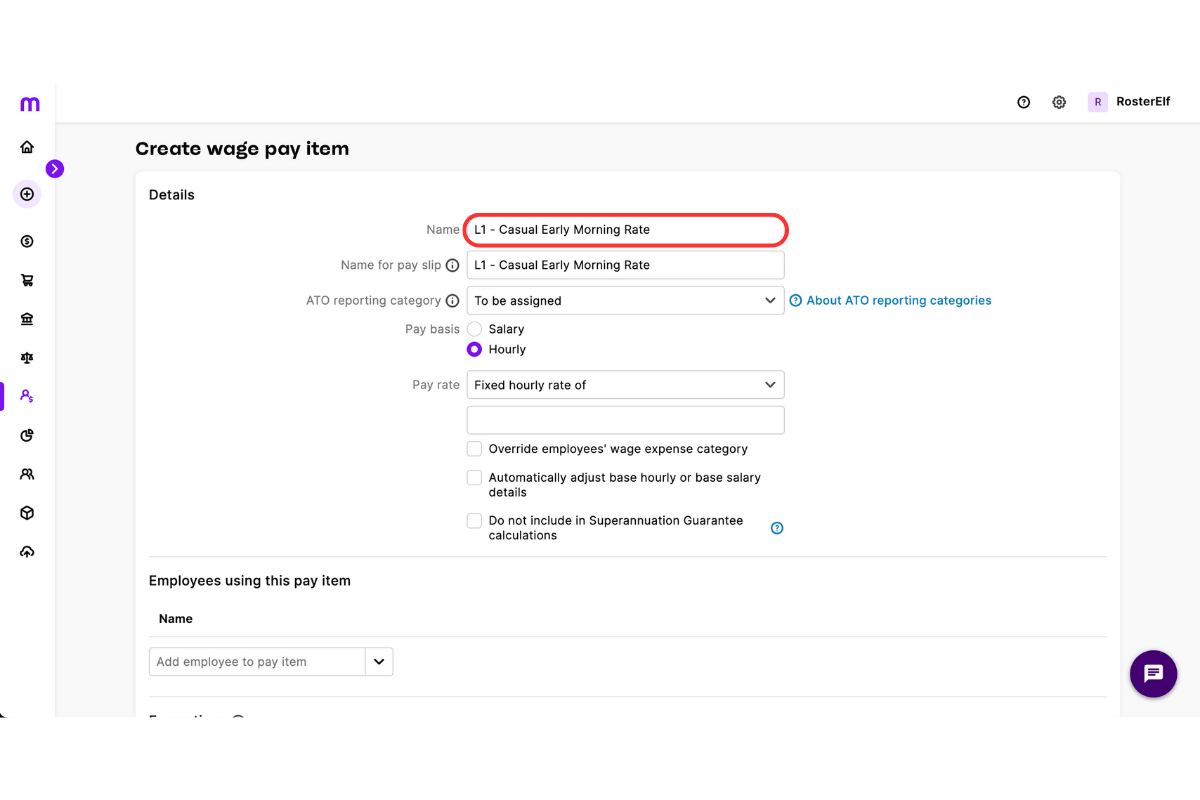

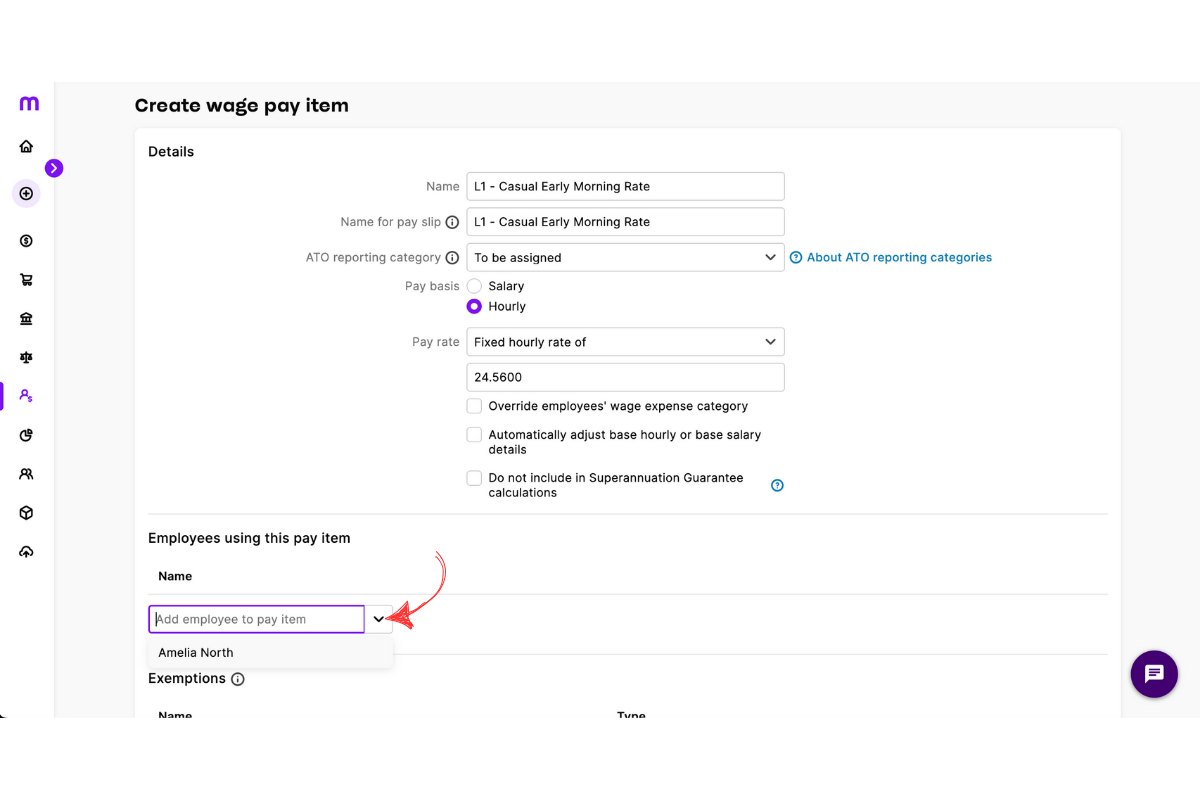

1.2.2 Enter the name of the pay item.

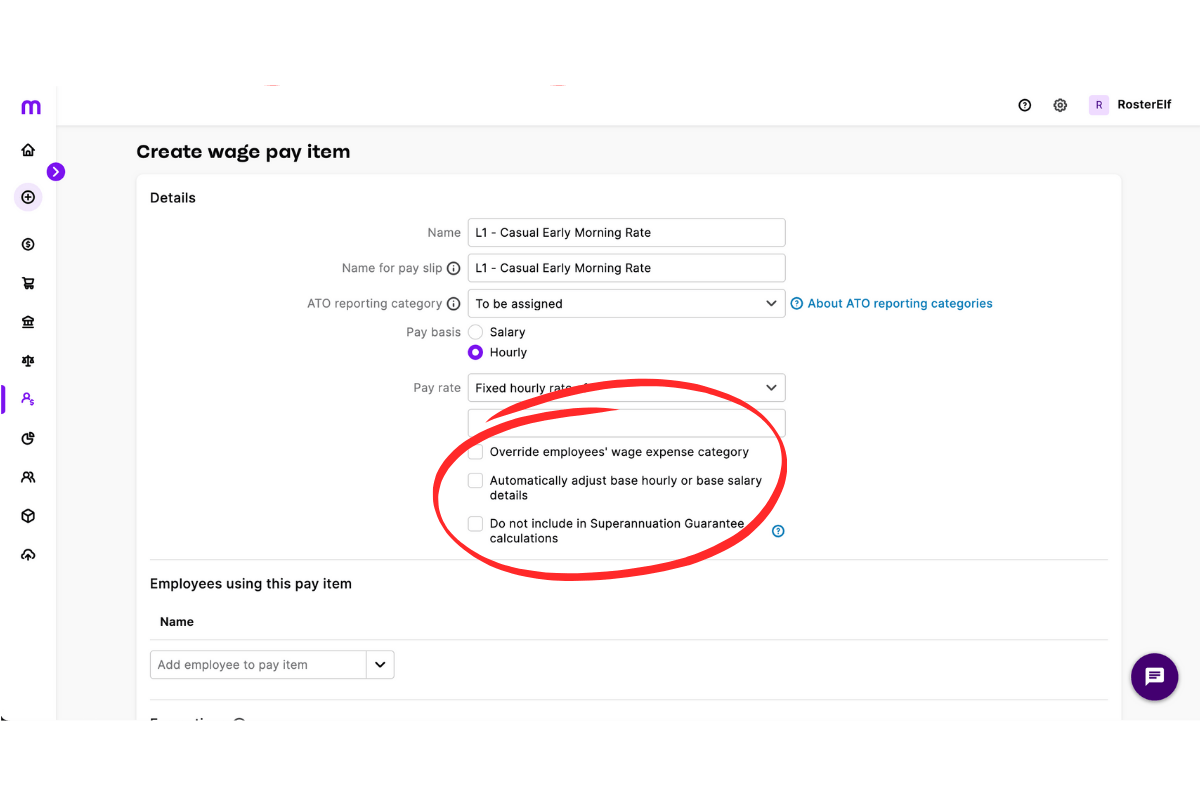

1.2.3 Review and check the pay item settings.

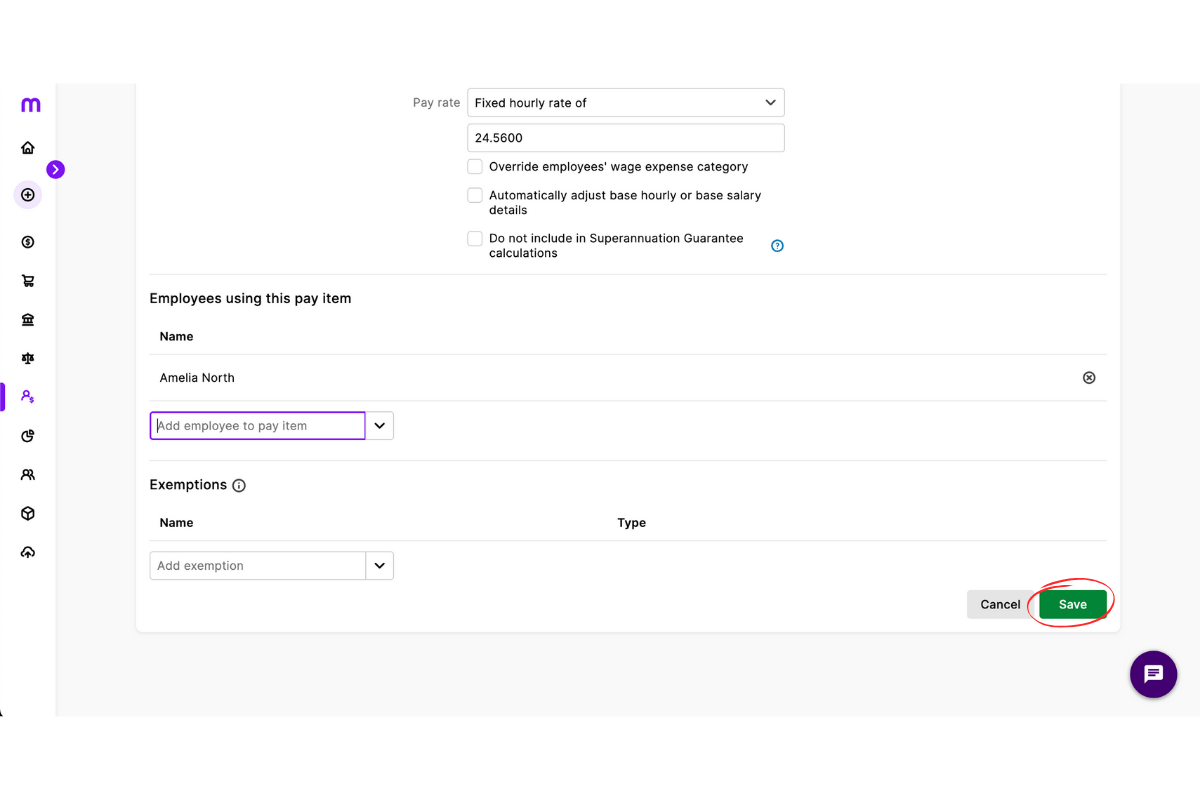

1.3 assign and save

1.3.1 Assign the pay category to the correct employee.

1.3.2 Press Save to complete the setup.