Hospitality payroll integration for shift-based venues

Hospitality payroll isn't straightforward. Penalty rates, split shifts, overnight trading, and casual loadings require payroll integration built for how venues actually operate.

-

Built for penalty rates and award interpretation

-

Designed for split shifts and overnight trading

-

One-click export to Xero and MYOB

Why hospitality payroll is uniquely complex

Penalty rates change throughout every shift

A single hospitality shift can span base rates, evening penalties, and late-night loadings. A split shift creates two separate pay entries. Weekend and public holiday penalties multiply costs further.

Manual payroll processing cannot keep pace with this complexity. Errors compound into underpayment claims, overpayment losses, and compliance risk that threatens both margins and reputation.

Payroll challenges unique to hospitality

These factors combine to make hospitality payroll fundamentally different from other industries.

Overnight penalties

Shifts crossing midnight with different penalty rates before and after 12am.

Split shift pay

Multiple clock-ins per day creating separate pay entries for each service period.

Junior & adult rates

Different base rates and conditions for staff across age brackets.

Weekend & holiday penalties

Saturday, Sunday, and public holiday rates that multiply labour costs.

Casual loading calculations

Casual staff receive loading in lieu of leave, adding to pay complexity.

High turnover processing

Frequent new starters and leavers requiring constant payroll updates.

Why hospitality payroll differs from other industries

Standard payroll systems fail in hospitality

Office workers receive the same salary each pay period. Hospitality staff earn different amounts every week based on hours worked, time of day, and day of week. Every shift is a calculation.

Labour cost mistakes carry higher consequences with single-digit margins. Overpaying erodes profit. Underpaying creates compliance risk and Fair Work exposure.

Payroll across different hospitality venues

Each venue type faces distinct payroll challenges shaped by trading hours, penalty structures, and workforce composition.

Restaurants & cafes

Split shifts across breakfast, lunch, and dinner create multiple pay entries per day. Short shifts where every minute affects pay accuracy. High casual ratios with variable weekly hours.

Bars, pubs & clubs

Late-night trading means shifts cross midnight with different penalty rates. Weekend penalties accumulate throughout Saturday and Sunday. Public holiday loadings are among the highest in any industry.

Quick service & franchises

Junior-heavy workforces with different rates for each age bracket. High turnover requires constant payroll updates. Consistency across locations is essential for multi-site operations.

Penalty rates calculated automatically

Correct pay without manual calculations

The Hospitality Industry Award has penalty rates for evenings, weekends, public holidays, and overtime. Calculating these manually for every shift is time-consuming and error-prone.

<a href="/features/payroll-integration/award-interpretation" class="text-primary-700 underline hover:text-primary-800">Award interpretation</a> applies the right rates as staff clock in. Timesheets arrive in payroll with penalties already calculated — no spreadsheets, no manual lookups.

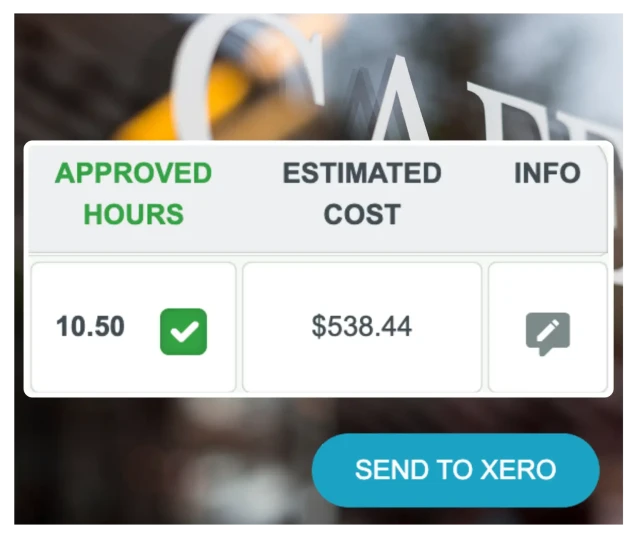

Export to Xero in one click

Approved timesheets flow straight to payroll

Hospitality managers don't have time for double data entry. Copying hours from timesheets to payroll wastes time and introduces errors.

<a href="/features/payroll-integration/xero" class="text-primary-700 underline hover:text-primary-800">Xero integration</a> sends approved timesheets directly to Xero with pay items already mapped. Draft pay runs appear ready for review — no re-keying required.

Send hours to MYOB instantly

Timesheets arrive ready to process

MYOB users need the same seamless workflow. Manual timesheet entry slows down pay runs and creates opportunities for mistakes.

MYOB integration exports approved hours with payroll categories already mapped. Staff receive correct pay without manual calculations or data transfer.

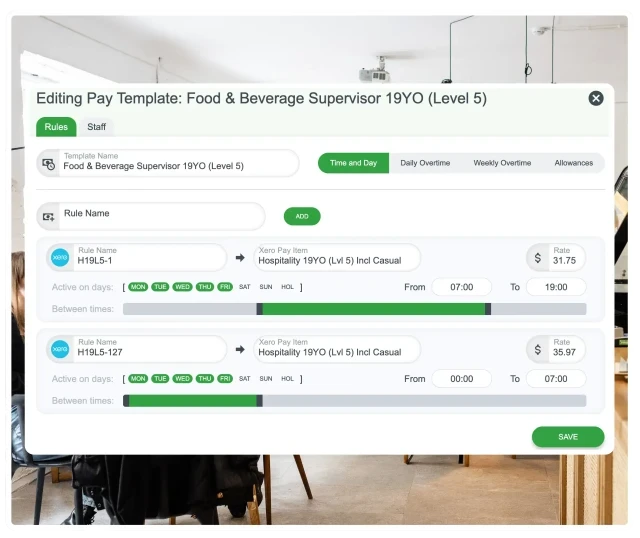

Rates configured for your venue

Your awards, your allowances, your rules

Every hospitality business has specific pay requirements. Different roles, different awards, different allowances. Generic payroll systems require constant manual adjustment.

The pay rate builder lets you configure rates, penalties, and allowances for your specific setup. Once configured, calculations happen automatically.

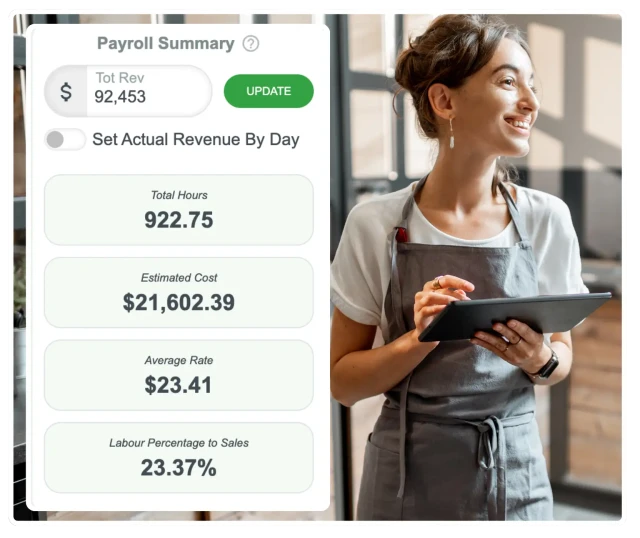

How payroll connects to hospitality operations

From roster to timesheet to payslip

Every shift rostered flows through to hours worked, which feeds payroll, which affects profitability. Disconnected systems create gaps where errors multiply.

When award interpretation is built in and timesheets export directly to Xero or MYOB, the entire chain stays accurate. <a href="/features/payroll-integration" class="text-primary-700 underline hover:text-primary-800">Explore RosterElf's payroll integration</a> to see how these pieces connect.

Compliance and awards in hospitality payroll

Accurate records protect your business

The Hospitality Industry Award requires precise penalty rate calculations based on when hours were worked. Evening rates, weekend rates, public holiday rates — all depend on accurate timestamps.

Payroll records also provide evidence during Fair Work disputes. Businesses with poor records face higher risk and penalty exposure. See the <a href="/guides/award-rates/hospitality" class="text-primary-700 underline hover:text-primary-800">hospitality award rates guide</a> for detailed compliance information.

Why hospitality businesses use industry-specific payroll integration

Payroll integration built for hospitality delivers measurable operational improvements.

Faster pay runs

Approved timesheets export to Xero or MYOB in one click.

Compliance confidence

Award interpretation applies correct rates automatically.

Labour cost accuracy

Actual hours match payroll — no surprises after processing.

Fewer disputes

Accurate records protect against underpayment claims.

Explore hospitality workforce solutions

Payroll integration is one part of managing a hospitality workforce. Explore related solutions built for the industry.

See how hospitality payroll integration works in practice

Book a hospitality-focused demo or start a free trial built for restaurants, cafes and venues.

Real support from people who understand your business

At RosterElf, support isn't a ticket system — it's part of the product. Our Australian-based team helps you set up correctly, understand award rules, and stay compliant as your business changes. No scripts. No offshore handoffs. Just real help when you need it.

-

Guided setup and onboarding

-

Award and payroll questions answered

-

Ongoing help as your team grows

Rated 5.0 by Australian businesses

Hospitality payroll questions

- Hospitality pay involves complex penalty rate calculations for evenings, weekends, and public holidays. Split shifts, casual workers with variable hours, and late-night trading all create payroll complexity that standard systems struggle with.

- The Hospitality Industry Award has penalty rates for Saturday, Sunday, public holidays, and evening/late-night work. A single shift can span multiple penalty periods, making accurate calculation essential for compliance.

- Restaurants and cafes deal with split shifts creating multiple pay entries per day, casual staff with fluctuating hours, junior rates for younger workers, and rapid staff turnover requiring frequent payroll updates.

- Late-night venues have shifts crossing midnight where different penalty rates apply before and after 12am. Accurate time capture and award interpretation ensure staff are paid correctly for every hour worked.

- Every minute recorded flows through to payroll calculations. Inaccurate clock-ins lead to underpayment claims, overpayment losses, and compliance risk. Precise time data is the foundation of correct pay.